The monthly salary of Jutta Urpilainen, Commissioner of the European Commission in charge of International Partnerships, is approximately EUR 21474. This brings the annual salary to EUR 257688.

Salaries of EU Commissioners 2019 – 2024

Basic salary

When you try to understand how salaries of EU officials are calculated, you are often directed at the ‘basic salary. However, the actual take-home remuneration package consists of many more components and be higher, lower, or similar to the basic salary depending of an official’s individual situation (family status, dependent children, relocation to Brussels from another country, etc.).

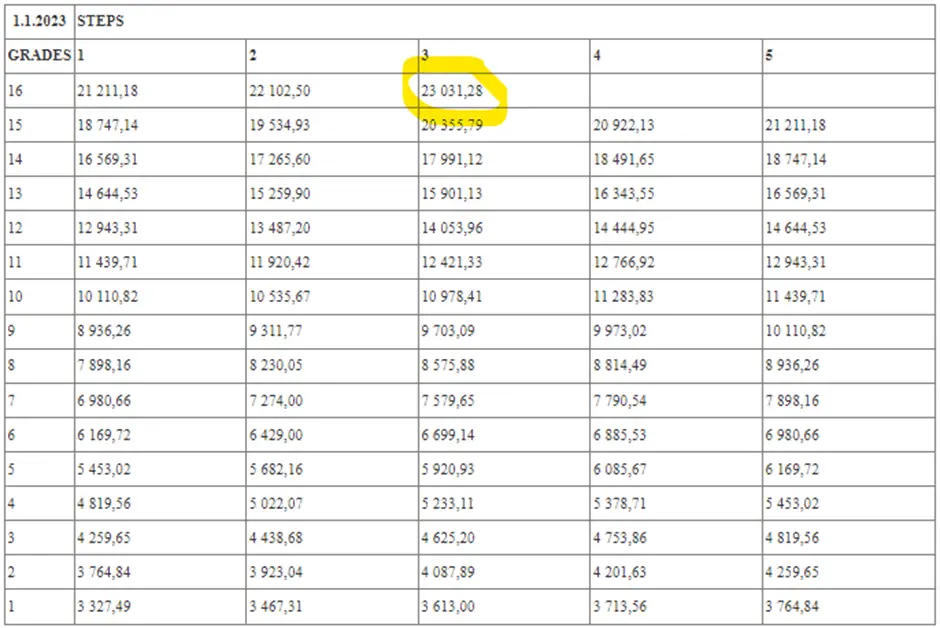

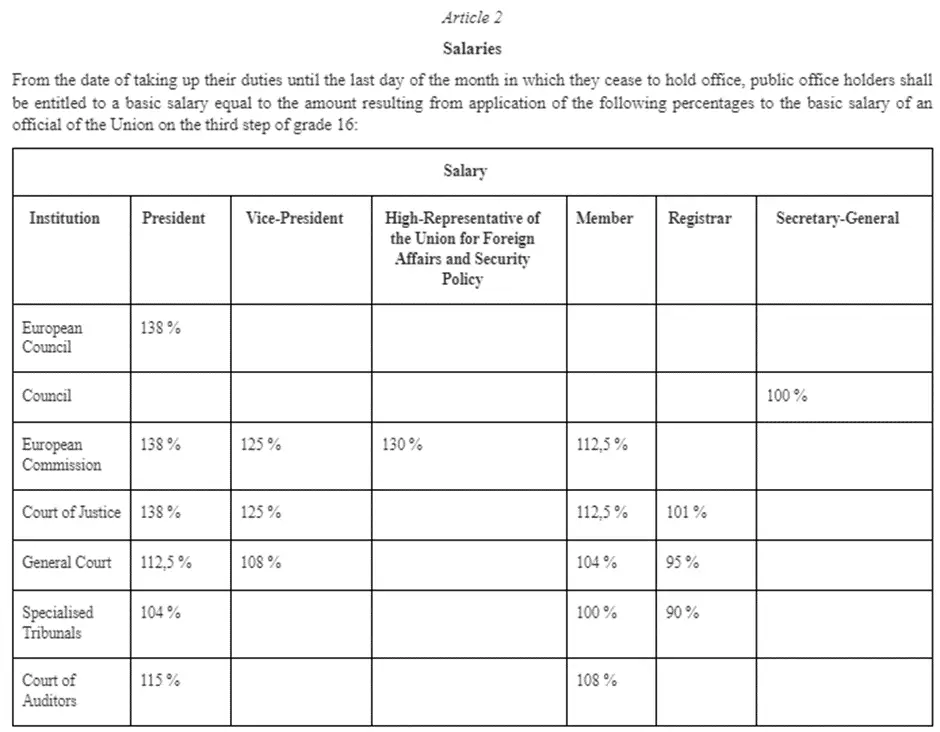

For a Commissioner of the European Commission, the basic salary is set at 112.5% of the basic salary of an official of the Union on the third step of grade 16, in other words, the highest basic salary possible for non-political posts in EU institutions like General Directors in DGs of the European Commission. For reference, since 1 January 2023 this number is EUR 23,031.28.

Allowances and other payments

As the European Commission Commissioner, Jutta Urpilainen is entitled to the following additional monthly allowances and other payments.

Residence allowance

Residence allowance equal to 15 % of their basic salary. This makes up EUR 3886.

Household allowance

Household allowanceequal to EUR 192,78 + 2% of their basic salary. This makes up EUR 711.

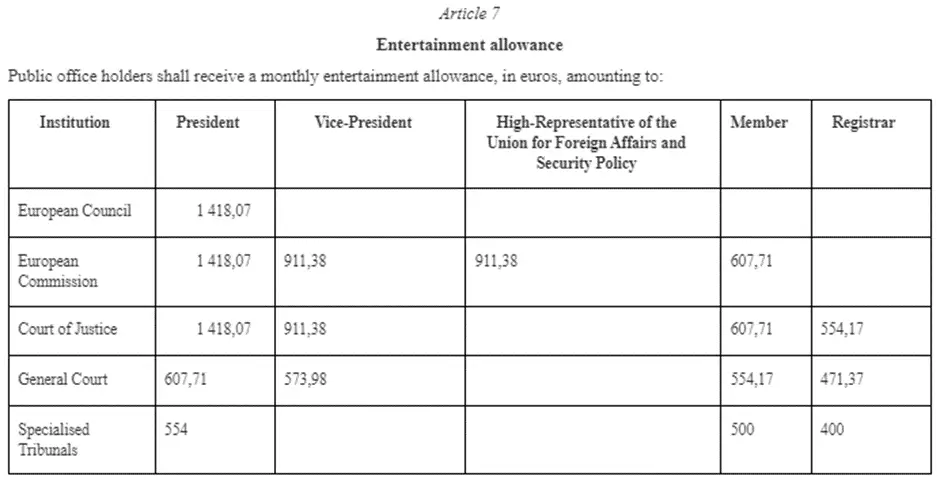

Entertainment allowance

Members of the European College are entitled to the weirdly named ‘entertainment allowance’, which most likely is an allowance for covering costs of work-related lunches and similar expenses.

This allowance ranges from EUR 607.71 for “regular” Commissioners to EUR 1418.07 for the European Commission President.

Dependent child allowance

Dependent child allowanceequal toapproximately EUR 440. This allowance amount not included in the total remuneration calculation as we don’t know the family situation of these EU officials.

Education allowance

Education allowance for children. This allowance amount not included in the total remuneration calculation as we don’t know the family situation of these EU officials.

Taxes and other deductions

Like other employees of the EU institutions, Jutta Urpilainen as Commissioner of the European Commission does not pay national taxes.

However, there are two European Union taxes.

Community Tax

Community Tax levied progressively at a rate of between 8% and 45 % of the taxable salary portion. We have not been able to find the exact rules about application of this tax, hence, we have assumed that the deduction is in the middle as 18.5% of the basic salary. This makes up EUR 4793.

Solidarity Levy

Solidarity Levy of 6%). This makes up EUR 1555.

There are also four social security-related deductions.

Pension

Pensioncontribution at 10.10% of the basic salary. This adds up to EUR 2617.

The European Commission College members have much more generous pension guarantees compared to regular EU staff. You can read more about the regular pension benefits for staff of EU institutions.

Health insurance

Health insurance contribution at 1.70% of the basic salary. This adds up to EUR 440.

The health insurance contribution makes the official eligible for the EU institutions health insurance scheme JSIS.

Accident coverage

Accident coverage contribution at 0.10% of the basic salary. This adds up to EUR 26.

Unemployment insurance

Unemployment insurance contribution at 0.81%. This adds up to EUR 210.

The European Commission College members have much more generous unemployment guarantees compared to regular EU staff. You can read more about the regular unemployment benefits for staff of EU institutions.

Background information

Basic salary coefficients for members of the College of European Commission

Entertainment allowance

Information about tax amounts and other salary deductions

For information about amounts of EU taxes, pension contributions, unemployment and other deductions see this document prepared by ECDC for candidates and staff. The same information applies to all EU institutions.

Image source: European Commission website