The remuneration package for Members of the European Parliament (MEPs) goes much beyond the monthly salary. This blog post provides a comprehensive overview of MEP salaries, allowances, and other benefits so that you can find out how much are your representatives receiving from the EU budget and taxes paid by you.

Below are the minimum income figures for a regular MEP. Heads of EP Committees, Vice Presidents, President and other MEPs with formal additional roles in the institution receive higher allowances and additional entitlements.

Monthly Salary and Similar Income € 8’000 – 18’600

As of January 1, 2024, the base salary of an MEP is € 10’377.43 gross, which translates to € 8’088.03 net per month after EU taxes and insurance contributions.

This translates to an EU tax rate of 22.06% for MEPs.

MEPs are also entitled to a payment called the General Expenditure Allowance (GEA), which is up to € 4’950 per month.

This comes to a total annual pay of € 97’056.36 – € 156’456.36.

Furthermore, each MEPs is entitled to a Daily Subsistence Allowance for every day when the European Parliament is in session (usually 4 days every week) and the MEPs are registered in the roll call. This allowance is € 350 per day and can add up to € 5’600 per month.

Do you find the figures hard to believe? Watch a video from an Italian MEP himself wondering about all of this.

This means that in practice the actual monthly income package for MEPs is significantly higher than the widely communicated ‘basic salary’.

General Expenditure Allowance

In theory, the General Expenditure Allowance of € 4’950 is intended to cover office expenses, travel within their member state, and other parliamentary activities.

However, as there is no control – MEPs are not required to provide invoices, receipts, or any details on how the funds are spent – these monies effectively are a supplement to an MEP’s salary.

There have been attempts by transparency activists to scrutinize GEA spending, however, this was completely shut down in 2018 by the Court of Justice of the European Union (CJEU) citing MEPs’ right to privacy which supposedly trumps the public’s right to know how public funds are spent.

Little wonder that only 4% or around 30 out of 720 MEPs transparently report on how they spend funds received from the European Parliament.

Here’s a handy video about MEPs’ job perks by the YouTube channel ‘EU Made Simple’:

Other Allowances

In addition to their salary, MEPs receive several allowances to cover expenses incurred while performing their parliamentary duties. These allowances include:

Daily Subsistence Allowance

The Daily Subsistence Allowance or DSA is €350 per day to cover accommodation, meals, and other expenses while in Brussels or Strasbourg. Again – in theory, this allowance is paid in full only if MEPs attend all parliamentary sessions and meetings. In practice, journalists regularly report on MEPs showing up at the start of parliamentary sessions and committee meetings to sign the attendance sheet, qualify for the allowance, and then leave the premises. This is one huge reason why there are so many empty seats in most broadcasts from the European Parliament.

The DSA can be collected only on days of Parliamentary activity – i.e. plenary sessions, group meetings or committee meetings. There are 16 such days in most months. If an MEP registers in the roll call for all of these days, the person’s monthly income is further boosted by up to € 5’600 each month.

The annual amount of this allowance is not easy to calculate as some of it is spent on hotel costs and rent, transportation and meals; also – MEPs might be absent for certain sessions of the European Parliament for justified reasons, and the DSA is not paid when the institution is in recess. As the MEPs can formally work for up to 150 out of the roughly 250 annual working days, the upper limit of this allowance per year can not exceed € 52’500.

The President of the European Parliament (currently – Roberta Metsola) is entitled to the DSA each day of the year, giving her additional € 127’750 annually (350 * 365) on top of the MEP salary and the General Expenditure Allowance.

Travel Allowances

Reimbursement for travel expenses to and from Brussels/Strasbourg, as well as for official missions within the EU.

MEPs are allowed to travel in business class by air and first class when travelling by train.

The rules about travel expenses make it difficult to calculate a monthly amount. However, MEPs are reimbursed the cost of 3 round trips to their home country and 1 trip to Strasbourg every month. Independent estimates indicate that most MEPs get an additional € 2’500 or more every month in this allowance.

MEPs also have access to the European Parliament’s fleet of vehicles in Brussels and Strasbourg.

Transitional Allowance (End-of-term Allowance)

MEPs are entitled to a Transitional Allowance, sometimes also called an ‘end-of-term-allowance.

The European Parliament’s website states the following about this allowance:

At the end of their term in office, MEPs are entitled to a transitional allowance, equivalent to one month’s salary per year they were in office for up to two years maximum. When a former MEP takes office elsewhere, the new salary offsets against the transitional allowance. If the MEP is simultaneously entitled to an old age or invalidity pension, they cannot receive both and must choose one or the other.

Source: EP website

I an not able to calculate the amount of this allowance myself, and haven’t found another good online source that would explain it and give figures.

My educated guess is that MEPs receive their basic net salary of € 8’088.03 for a period between 6 and 24 months. If you are more certain about your calculations or have found a credible source, please let me know in the comments.

Special Allowances for EP President and Vice-Presidents

EP President and Vice-Presidents receive a monthly Representation Allowance, similar to EU Commissioners. This ranges from around € 800 – 1’418.

The EP President also receives a Residence Allowance of around € 3’000.

Other Benefits

Pension

After their term of office, MEPs are entitled to a pension equal to 3.5% of their salary for each full year in office, up to a maximum of 70%. This pension is paid from the EU budget.

Medical Insurance

MEPs are reimbursed for two-thirds of their medical expenses.

This is one benefit that’s in fact less generous for MEPs when compared to regular EU institutions staff. Statutory staff of EU institutions are members of the Joint Sickness Insurance Scheme that reimburses 80-85% of most healthcare costs.

Funds to Hire Staff

MEPs are allocated funds to hire staff to assist them with their parliamentary duties. The total monthly amount for these expenses is €29,557 in 2024.

MEPs can hire whomever they want, however, they are forbidden to hire family members.

These funds cannot be pocketed by the MEPs as they select their staff, but their contracts are signed directly between the staff member and the European Parliament.

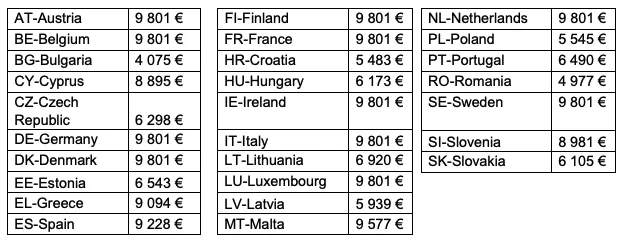

The highest amount of monthly salary that MEPs are allowed to pay one aide in Grade 19 are listed in the below table. Most MEP aides received significantly less than this amount in their monthly salary.

Similar to other salaries and allowances in EU institutions, these values are reviewed at least once annually in line with the current inflation/deflation statistics.

National taxes

MEPs income from the European Parliament can be subject to national taxes. There is no EU-wide database about the effects of national taxation on MEPs’ income, but you can inquire with the national state revenue authority to find out if and how MEP salaries and allowances are taxed on the national level.

Transparency and Accountability

While MEPs are encouraged to report to the public about their usage of the various allowances, particularly, the General Expenditure Allowance and the Staff Allowance, very few MEPs actually do this.

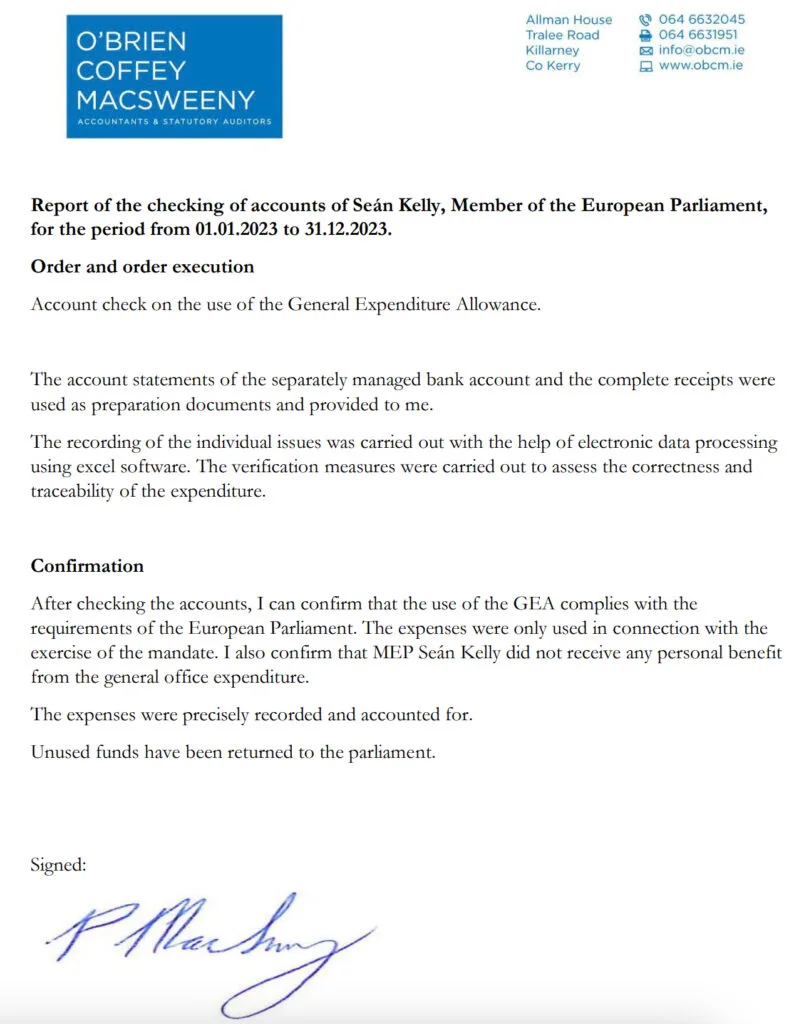

Two of the best examples come form Ireland, but are a rare exception.

- Website of the Irish MEP Seán Kelly, that includes an annual external auditor’s report on how the GEA was spent.

- Website of the Irish MEP Ciarán Cuffe, where he self-reports how staff funds and GEA was spent.

Further Reading

- Salaries and pensions | News – European Parliament, European Parliament

- Allowances | News – European Parliament, European Parliament

- MEPs reject scrutiny of their expenses, Politico.eu

- MEPs can’t hire relatives? Ask the Latvians how to get around the rules, re:baltica

- Ukip leader Nigel Farage defends employing German wife, The Independent