An official calculator of salaries for jobs in the European Commission or other EU institutions is not publicly available. To address this gap, this article links to a number of useful resources that will allow you to get an approximate idea of what salary to expect at a particular EU institution.

‘Basic pay’ vs actual salary

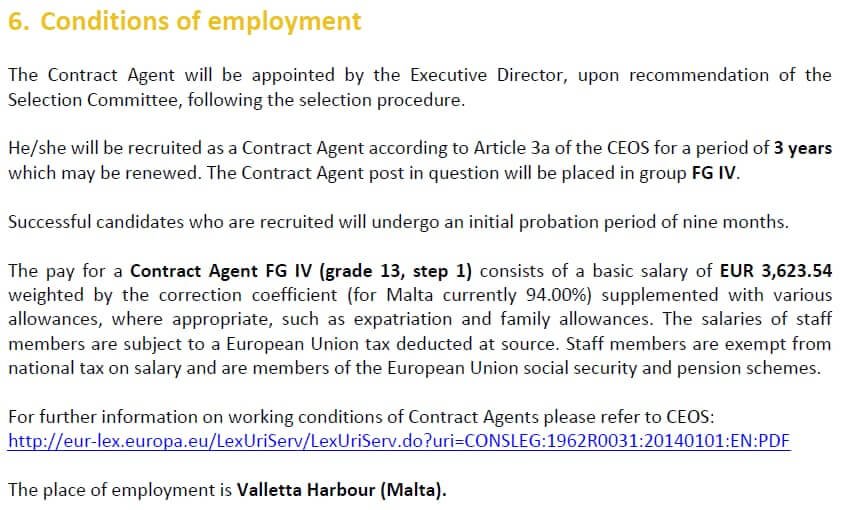

EU institutions increasingly list the so called ‘basic pay’ adjusted by the Correction Coefficient in their vacancy announcements. This gives a potential employee some idea of what income to expect, however, it can be way off from the actual figure of ‘take-home salary’ due to allowances and other factors.

As an example, for Administrators AD5 the net monthly take-home remuneration package can range anywhere from 85% to 125%+ of the basic pay amount depending on individual circumstances such as expatriate status, number of dependents, civil status (marriage or recognized partnership), length of time spend outside home country and other factors. The range of variation is similar for other types of contracts and grades.

If you are like most people, you would prefer a bit more certainty before embarking on a new job, particularly, if it involves moving to a new country and relocating your significant other or the whole family with you.

EU agencies’ salary calculators

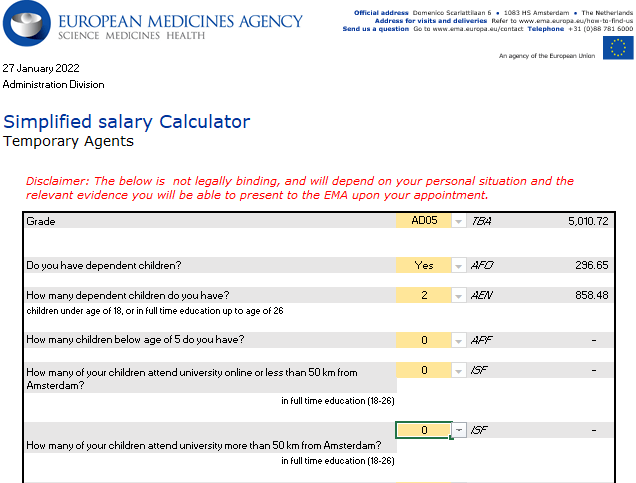

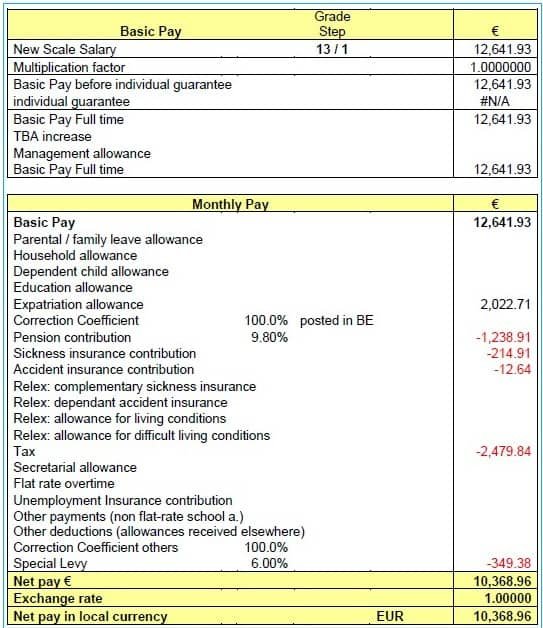

I have found only one EU institution – EMA, the European Medicines Agency, located in the Netherlands – which has published two salary calculators for their prospective employees. One of the calculators applies to Administrators (AD 5-8, AD 10, AD 12) and Assistants (AST 3-8, AST 10, AST 12), the other to Contract Agents in FG III in grades 8-9 and FG IV in grades 13-14.

Download the European Medicines Agency Simplified salary calculators:

Source: EMA website

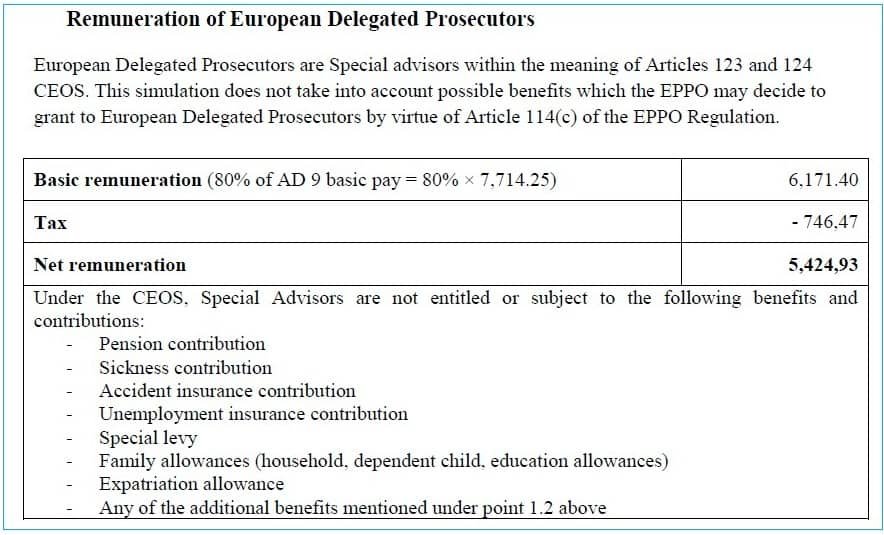

EPPO, the European Public Prosecutor’s Office, has a different approach to communicating salaries. As far as I’m aware, they are the only EU institution that provides a finely detailed calculation of what European Prosecutors working for the EPPO and European Delegated Prosecutors (like SNEs, but better paid) will receive as salary/compensation. Below is a screenshot from the EPPO document for both categories, but you can find more salary scenarios by downloading and consulting the full file “Remuneration and benefits for European Prosecutors and European Delegated Prosecutors working for the EPPO” (original source).

Of course, the table above provides an insight into what the European Prosecutors can expect to earn, based on their personal situation. If you want to work for EPPO in another position, read the article below.

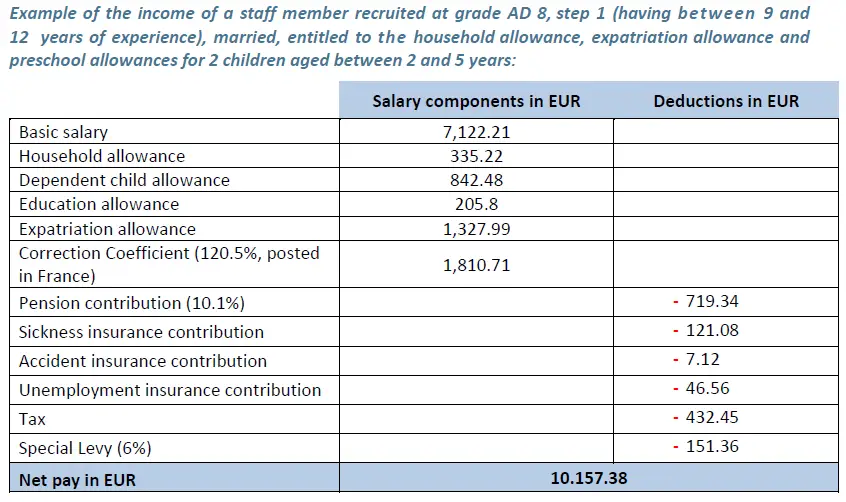

While the European Banking Authority in Paris does not provide a salary calculator, it also does provide a somewhat helpful calculation of what an expat AD8 with children would get if employed at EBA. Unfortunately, similar calculations are not available for other function groups and grades.

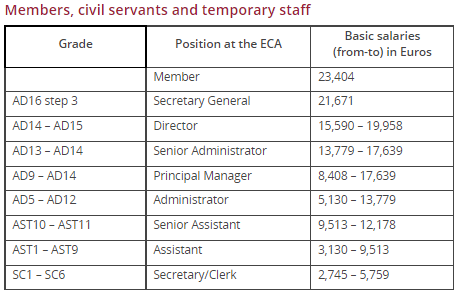

The European Court of Auditors, the main EU auditing body, has also done a somewhat decent job in listing at least the ranges of basic salaries for function groups AD, AST, AST/SC and Contract Agents.

Visit the ECA website for more details.

If you find a salary calculator or similar information for another EU institution, please let me know and I’ll add it to this article.

Calculation of salaries by EU staff category and grade

In order to compensate for the lack of better information about salaries in EU instituitons, I have collected information from the Staff Regulation and public sources and done an approximate calculation of salaries for Administrators grades AD5 to AD16, Assistants in grades AST1 to AST11, and Contract Agents in grades FGI to FGIV. Click on the links below to find out what will be your salary under a particular job contract, grade and step.

Administrators

* Salary of Administrators AD5

* Salary of Administrators AD6

* Salary of Administrators AD7

* Salary of Administrators AD8

* Salary of Administrators AD9

* Salary of Administrators AD10

* Salary of Administrators AD11

* Salary of Administrators AD12

* Salary of Administrators AD13

* Salary of Administrators AD14

* Salary of Administrators AD15

* Salary of Administrators AD16

Assistants

* Salary of Assistants AST1

* Salary of Assistants AST2

* Salary of Assistants AST3

* Salary of Assistants AST4

* Salary of Assistants AST5

* Salary of Assistants AST6

* Salary of Assistants AST7

* Salary of Assistants AST8

* Salary of Assistants AST9

* Salary of Assistants AST10

* Salary of Assistants AST11

Contract agents

* Contract Agents FG I

* Contract Agents FG II

* Contract Agents FG III

* Contract Agents FG IV

All articles in the series “Salaries in EU institutions”

These article series provide an overview of salaries by EU institution that are adjusted by the appropriate correction coefficient, so you would know what you can expect to earn if you will work outside Belgium.

Allowances and other benefits for EU institutions staff

Several allowances and other benefits can quite significantly boost an EU official’s income. This largely depends on whether the person is an expat and has a spouse and/or children. When considering a job at an EU institution, people too often do not take these benefits into account. Important – these benefits are available to Administrators in grades AD 5-16, Assistants in grades AST 1-11, Secretaries and Clerks in grades AST/SC 1-6, and Contract Agents in grades FG I-IV.

- Travel costs on taking up duties

- Daily subsistence allowance (during probation period)

- Installation allowance and coverage of removal costs (one-time payments)

- Expatriation allowance or Foreign Residence allowance

- Household allowance

- Dependent child allowance

- European School enrollment for children or Education allowance if there is no local EU school

- Healthcare costs reimbursement to a level of 80-85% through the EU’s Joint Sickness Insurance Scheme (JSIS) for the employee and any direct family members and dependents. 100% reimbursement of costs in case of a serious illness

- Accident insurance

- Annual travel compensation

- Birth grant

- Parental leave

- Unemployment allowance

- Removal expenses when leaving your home country and again when leaving your EU institution

- EU pension, survivors and orphan’s pensions, invalidity allowance

- Lump sum payments in case of permanent invalidity or death

- Lump sum funeral expenses, up to EUR 2350

Taxes

Salaries of EU institutions staff undergo a number of deductions (pension contribution, health insurance contribution, accident insurance, special levy (until 31 December 2023)) and are adjusted by the Correction Coefficient before their salaries are paid out. Besides these, EU staff do not have to pay any national taxes, unless they choose to do so and the national social insurance system allows such voluntary contributions to accumulate pension rights under a national system.

Do you have question or suggestion for this article? Please share in a comment below and let’s make this resource better for you and other readers!

4 responses to “Calculators of salaries in EU institutions”

One question, if you move from one agency to another to in different country and they consider you probation has been done already are you still entitled to DSA?

Thank you

The aim of the DSA is to allow you to settle into a new country and also compensate for uncertainty during the probation period, as you might be not hired at the end of it. Hence, if you move to a new country, I have not heard of a case where there would not be a probation period and the associated DSA.

In the agencies I’ve worked in, there were always probation periods even when staff moved to another position within the same institution. However, if the person was already settled in the country, there was no DSA.

As usual, I suggest to address separately the HR of your current institution and the next institution to get qualified advice in your particular situation.

One more question on the household allowance: I read that somebody who has no children but is married can qualify for the household allowance, but only if the spouse does not earn more than a specific amount (before tax) per year. Is that right? And if yes, do you know how high that maximum income amount for the spouse is?

Thank you!

Sue

Hi! I have a question regarding the household allowance. Is it really only applicable for expats? I think I read somewhere that the household allowance depends on if you are married or not?

Thank you,

Sue