Key Takeaways

- JSIS coverage is one of the most underappreciated benefits of working for EU institutions

- JSIS reimburses 80-85% of most healthcare costs and medicines

- Spouse, children, and other dependents are also insured

Introduction

The Joint Sickness Insurance Scheme (JSIS) is a comprehensive health insurance system created specially to cover the needs of ‘statutory’ staff working for the European Commission and other EU institutions. JSIS also provides health insurance to retired EU institutions’ staff.

JSIS offers a very wide coverage of medical conditions, as well as accidents, and maternity.

In most cases, staff of EU institutions pay all expenses out of pocket, and then submit a reimbursement claim to recuperate expenses in the 80-85% range. Amount of reimbursement depends on the type of healthcare service or medicine received.

In the case of recognized ‘serious illnesses’, the reimbursement rate is 100%. This is why it is in your interest to disclose information during the European Commission medical examination.

In case of large planned healthcare expenditure, e.g., long-term hospital stays or surgery, it is usually possible to arrange direct payment between JSIS and the healthcare provider.

There is a relatively large number of healthcare services and medical products, that require ‘prior authorization’. Read more about this below.

Eligibility for JSIS

Statutory staff categories enrolled in JSIS

You will be covered by JSIS if you are applying for positions of Administrators AD5-16, Assistants AST 1-11, Secretaries and Clerks AST/SC 1-6, and Contract Agents FG I to FG IV. You will be covered by JSIS if you are a Temporary Agent or Accredited Parliamentary Assistant, as these are in practice sub-categories of the above.

JSIS coverage is also extended to political positions such as European Commission Commissioners, Members of the European Parliament (MEPs), Judges of the EU Court of Justice (CJEU).

You will not be covered by JSIS if you are a Seconded National Expert (SNE), Interim, Intramuros, or Trainee.

EU institutions’ staff member & dependents

All EU institutions’ staff and their dependents (children, but also elderly family members) are automatically covered by JSIS.

JSIS is as primary health insurance coverage for EU staff.

For dependents and spouses JSIS serves as secondary cover. This means that sometimes JSIS might request proof that you have addressed your home-country healthcare system and they have either partially covered or denied coverage of healthcare costs.

Spouse or recognized partner

Spouses / recognized partners can have JSIS as secondary cover if their annual income does not exceed a certain rather high threshold.

JSIS and retirement

EU institutions’ staff and their spouses / recognized partners retain JSIS coverage if they have qualified for the EU institutions’ pension (at least 10 years of total employment in EU institutions). You have JSIS coverage irrespective of the length of employment in EU institutions (10-45 years) and the amount of your EU pension.

How to enrol in JSIS

You do not have to take any steps to enrol in JSIS.

Once you sign your employment contract, you are enrolled automatically by your institution’s HR.

Often, coverage is delayed by 1-2 months due to length of administrative procedures. If you or your family members incur healthcare costs in this period, you just have to save all invoices, and file a reimbursement claim when your SIS enrolment is finalized.

Benefits of JSIS

JSIS provides extensive medical coverage for its beneficiaries.

You can get reimbursements not only for healthcare services, but also a large number of medicines / similar medical products. Even some vitamins are reimbursed!

To get reimbursement for medicines, you will need a prescription from a doctor. If there is no prescription, you will not be reimbursed.

In the first months of starting to use JSIS or in case of a new medical procedure or medicine, it is best to consult JSIS in advance to make sure you satisfy all preconditions for reimbursement.

Some medicines require a prior authorization in addition to getting a doctor’s prescription.

While to get reimbursed for most healthcare services, you just need to submit the invoice issue to you or a family member, there are some more “complicated” cases. Here are some examples:

- Orthodontic treatments require a cost estimate and approval of it by JSIS. There is also a global limit to costs.

- Psychotherapy requires a referral by a psychiatrist or neurologist.

- Dental braces are reimbursed for children up to 18 years of age, but not for adults.

Types of costs covered by JSIS

JSIS covers a wide variety of medical services. Below is an overview of some popular services, but the actual list of covered services is much wider.

Medicines

JSIS covers a wide assortments of medicines, provided that they are actual medical drugs and you have a doctor’s prescription. JSIS even covers some vitamins like C, D and multivitamins (Vitiron).

To be certain that you medicines purchases will be reimbursed, check them in advance in JSIS.

Hospitalisation Coverage

JSIS offers hospitalisation coverage to ensure that you do not face any financial hardships during in-patient care period. If hospitalisation is due to planned healthcare procedures, it might require prior authorisation.

Dental treatments

Most dentist and orthodontist services are covered under JSIS.

There are certain cost limits per every calendar year or a longer period. For example, general dental treatments (fillings, descaling, etc.) are reimbursed at the rate of 80 % with a

ceiling of €750 per calendar year for each family member. However, more serious dental procedures like braces for children or orthodontic procedures have separate limits.

Glasses and contact lenses

JSIS reimburses costs of optical glasses and contact lenses. You can get regular glasses replace once in two years, and there is a limit for the frame, and each of the lenses; eye checks and other costs are additionaly reimbursed. Contact lenses have a limit of around 500 euros annually.

Mental Health

JSIS acknowledges the importance of mental health and therefore includes provisions for mental health coverage.

JSIS covers not only psychiatry and neurology services, but also access to professional counselling and psychotherapy.

Maternity

Even though the paid maternity period in EU instituitons is laughably short and modelled on the past French system, JSIS has quite generous maternity cover.

Coverage includes prenatal care, delivery, postnatal care, and related medical services.

Disability and long-term care

JSIS offers disability and long-term care coverage for situations where you may require extended support. This may include services such as home nursing, rehabilitation, or assistance with daily activities in case of a chronic illness or disability.

Coverage for services provided over a longer period of time usually has a larger administrative burden to prove that they are really necessary and that costs are rational.

Read our article about disability and work in EU institutions.

What is a serious illness?

If you have a ‘serious illness’ that’s recognized by JSIS, you can get a 100% reimbursement rate of medicines and medical services related to the medical condition instead of the regular 80-85%.

As soon as you are enrolled in JSIS or become aware of the serious health condition during your employment at an EU institution, you’ll have to prepare a request in the JSIS online platform for the condition to be recognized. This will require a medical report that has at least the following elements:

- exact diagnosis

- date of diagnosis

- stage of the illness

- complications

- required treatment

For an illness to be recognised as serious, it has to have elements of the following:

- shortened life expectancy

- the illness is likely to be drawn-out

- need for aggressive diagnostic and/or therapeutic procedures

- presence or risk of a serious handicap

Issues with JSIS

Being covered by JSIS is mostly about advantages. However, there are also some issues to be aware of:

- Reimbursement limits: Often JSIS covers costs up to a certain limit. For example, 35 euros for a general practitioner, and 50 euros for a specialist doctor. In many EU member states actual costs of a visit are higher than this. It pays to inquire about these limits and know the main rules. For example, often a GP might have a specialty like a pulmonologist. In this case you can request an invoice for the services of a pulmonologist, and get the higher reimbursement ceiling.

- Administrative requirements: Reimbursement of some healthcare services and medicines requires additional procedures and documents like prescriptions, referrals, prior authorization, specific claim forms (e.g. dentist services) etc. If you do not get these ahead of your visit, your reimbursement claim might ge denied. On a positive note, JSIS is quite forgiving and allows you to re-submit a claim with additional documentation if you have managed to get it.

- Potential issues for disabled persons: There have been strategic inquiries conducted by the European Ombudsman to determine whether JSIS’s treatment of persons with disabilities complies with the UN Convention on the Rights of Persons with Disabilities (UNCRPD). These concerns may affect the scheme’s long-term viability or lead to changes in coverage for persons with disabilities.

- Coverage issues for spouses: JSIS will be secondary cover for your spouse or recognized partner. This means that quite often you will need to contact your national healthcare scheme to request a certificate that healthcare costs of your spouse will not be covered (or be partially covered) by the primary health insurance scheme. This certificate needs to then be submitted to JSIS. The procedure is not difficult, but might add on average 1-3 months to securing a reimbursement of costs for your life partner.

How JSIS Works

How quickly are claims processed

When you submit a claim to JSIS, the documents are first reviewed and eligibility of costs ascertained. If approved, the reimbursement process typically takes between 1-4 weeks.

How to access healthcare services

JSIS does not regulate which doctors you can see in a particular EU country. If their costs will be above JSIS limits, JSIS will reimburse amounts up to the set limit.

However, in some EU countries you might experience healthcare access dificulties due to national requirements that are not related to JSIS.

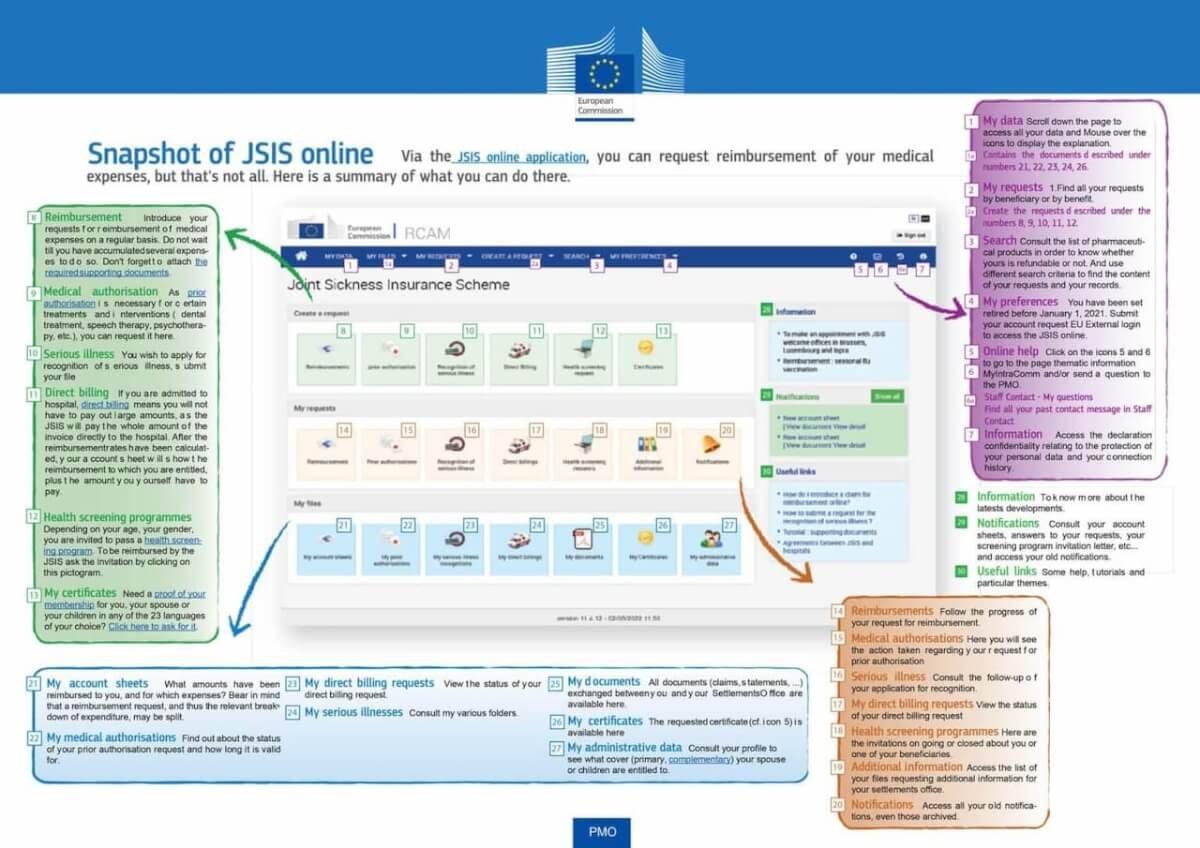

How to file a claim

While it is still possible to file paper claims by post, JSIS now has a very convenient electronic system.

All that is required for most claims is an invoice or a receipt on the name of you, your spouse / recognized partner, or children, which you upload in the system. In addition to this, you have to input some information manually like the amount paid, date of receiving a service or purchasing a medicine.

Some costs like dental services require the uploading of a special form that is signed and stamped by the dentist.

You have to preserve copies of all submitted documents for 18 months from the date of submitting the cost claim in JSIS.

How to appeal a claim denial

Occasionally, reimbursement claims are declined for administrative reasons, such as poor scan quality of submitted documents, missing or incomplete form, insufficient information in an invoice (e.g., number of service provision times and dates not indicated). In these cases:

- Review the information provided by JSIS regarding the reasons for the claim denial.

- Gather additional documentation or information that may help support your case.

- Re-submit the claim in JSIS, but uploading old and new documents.

Frequently Asked Questions

JSIS usually reimburses 80-85% of most healthcare costs and medicines prescribed by a doctor. The Joint Sickness Insurance Scheme (JSIS) is regulated by the General Implementing Provisions for the reimbursement of medical expenses and the codes (GIP).

JSIS can only be accessed by current and former staff of EU institutions that have valid login details.

Telephone hotline every day from 9:30 to 12:30

Brussels: +32-2-29 76888

Ispra: +39 0332 78 30 30

Luxembourg: +352 4301 36100

Addresses of physical JSIS welcome desks.

For members of JSIS, the most effective way to clarify a situation is to contact the PMO through the JSIS ticketing system.

Yes, JSIS covers family members of EU officials, including dependants such as children and spouses.

Spouses might not be covered by JSIS if their annual income exceeds a certain threshold set for each EU country.

If you become unemployed after working for the EU institutions, and are entitled to the EU institutions unemployment allowance, then you will retain JSIS coverage for the duration of the unemployment leave.

You can submit costs claims for medical services and medicine purchases done in the past 18 months.

14 responses to “JSIS Joint Sickness Insurance Scheme: A guide for new staff of EU institutionss”

Hello, I’d like to know what medical insurance is offered for positions in EU delegations? Is it also JSIS? Thank you

I just learned that even if dependent children get a primary cover under JSIS, they are not covered in case of accidents. What does that mean in practice? If they fall on the playground and break an arm, for instance, medical costs for their treatment will not be covered? So you actually need a complementary insurance for this? What are the options? So far I wasn’t able to find any good information on this matter. Thanks in advance!

Does JSIS cover vaccines, specifically HPV vaccine?

Hi there,

I recently did the medical exam and was deemed apt to work with reserves meaning that I am excluded from invalidity coverage for five years. I strongly disagree with the grounds of the reserves and so does my doctor.

I was wondering if you knew – or if there was anyway to know – what type of grounds of appeal are possible and how I can argue my case in such an appeal. What type of argumentation and position usually works?

thank you so much for any help you could provide!!

I’m joining EU from France. My wife and i get used to 100% coverage as French companies usually cover their staff. I would like to know is there is a good complement to JSIS and how i can suscribe for one knowing my wife is not working.

Don, hi! I’m not aware of a good solution. There are some offers for EU institutions’ staff working in Brussels, but I have no idea what is the take-up rate of the offer.

For most people the 15-20% co-payment appears to be reasonable and, unless you’re experiencing very high healthcare costs, might be less than a contribution to some insurance plan.

Hi there,

If I have a chronic disease diagnosed before enrolling with JSIS and the disease requires ongoing medication and potentially surgery some day, are these also covered by JSIS or only ones that are diagnosed after joining the commission?

Hi! Pre-existing conditions do not disqualify you. However, some conditions make make you ineligible for the death grant and disability pension if you/your relatives claim these in the first 5 years of employment. I believe this is described in the article.

Hi Ben,

short question: how does it look like when you are getting EU pension (from working at the COM) and are covered by JSIS and BE pension (from working in Belgium for some years) then you go to the doctor let´s say in Belgium – will you get full rembursment from JSIS or you must run your expenses via BE mutelle first?

You can try to first submit to JSIS. Only if they decline with the reason “Refusal from the primary healthcare scheme is missing”, only then you have to approach the Belgian authority and ask them to either reimburse or send you a letter informing that they will not reimburse.

I experience this frequently. I write to my national authority in case of my family every semester asking to confirm that they will not reimburse the costs, and them resubmit the costs to JSIS with the national authority’s letter attached. A hassle, but usually worth it.

I reuse the same letter every time, just add the current annexes.

My husband (not a Commission employee) is not entitled to JSIS due to his salary earnings. Once he retires, and is then only receiving a pension, can he be added to my JSIS scheme, for both of us to benefit from JSIS once we both retire?

My understanding is that it’s a “yes”, provided that his pension does not exceed the same limits as for the salary. As pensions are usually lower than previous salary, he would hopefully qualify.

Will I be covered by the ISIS when I am retired and receive a EU pension? If yes, how much does the ISIS cost monthlyin this case?

Thanks

Best regards

Jörg Förster

Yes, this is one of the nicest benefits of receiving an EU pension – that you also are covered by JSIS even if you worked elsewhere before you became entitled for the EU pension. There is no co-payment and the rules are the same, i.e., 80-85% reimbursement of most costs (within ceilings).