The monthly salary of Christophe Hansen, Commissioner for Agriculture and Food, is approximately EUR 22’334. This brings the annual salary to EUR 268’012.

Salaries of EU Commissioners in VDL’s 2nd Commission (2024-2029)

Short BIO of each Commissioner from Politico.eu.

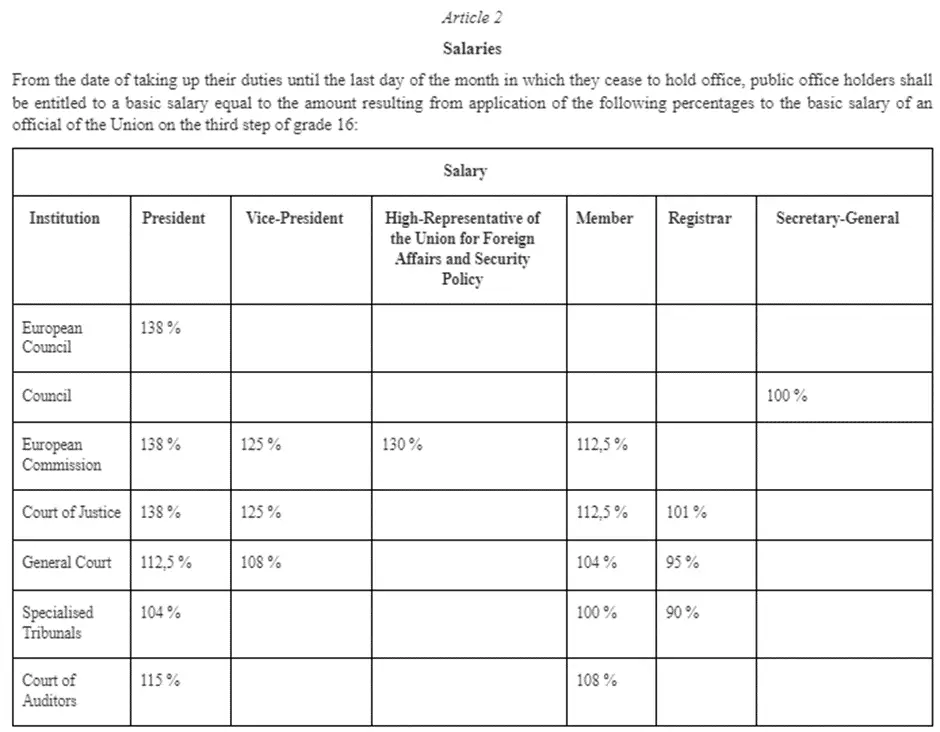

Basic salary

When you try to understand how salaries of EU officials are calculated, you are often directed at the ‘basic salary. However, the actual take-home remuneration package consists of many more components and be higher, lower, or similar to the basic salary depending of an official’s individual situation (family status, dependent children, relocation to Brussels from another country, etc.).

For a Commissioner of the European Commission, the basic salary is set at 112.5% of the basic salary of an official of the Union on the third step of grade 16, in other words, the highest basic salary possible for non-political posts in EU institutions like General Directors in DGs of the European Commission.

For reference, since 1 January 2024 the highest EU civil servant ‘basic salary’ is EUR 23,959.44.

Source: Article 66 of the EU Staff Regulations | See the full European Commission salary grid

Allowances and other payments

As the European Commission Commissioner, Christophe Hansen is entitled to the following additional monthly allowances and other payments.

Residence allowance (similar to Expatriation allowance)

The Residence Allowance is equal to 15 % of their basic salary. This makes up EUR 4043.

Household allowance

The Household Allowance is equal to EUR 192,78 + 2% of their basic salary. This makes up EUR 732.

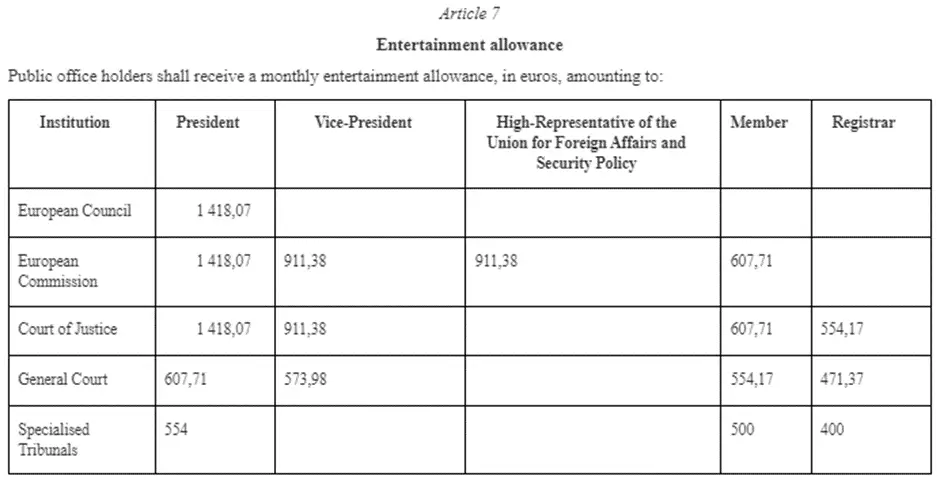

Entertainment allowance

Members of the European College are entitled to the weirdly named ‘entertainment allowance’, which most likely is an allowance for covering costs of work-related lunches and similar expenses.

This allowance ranges from EUR 607.71 for “regular” Commissioners to EUR 1418.07 for the European Commission President.

Dependent child allowance

The Dependent Child Allowance is equal to approximately EUR 440. This allowance amount is not included in the total remuneration calculation as we don’t know the family situation of these EU officials.

Education allowance

The Education Allowance is not included in the total remuneration calculation as we don’t know the family situation of this EU official.

Taxes and other deductions

Like other employees of the EU institutions, as Commissioner of the European Commission Christophe Hansen does not pay national taxes from his EU salary or allowances.

However, there are two European Union taxes the Commissioner has to pay.

Community Tax

The Community Tax levied progressively at a rate of between 8% and 45 % of the taxable salary portion. We have not been able to find the exact rules about application of this tax to European Commissioners’ salaries, hence, we have assumed that the deduction is in the middle as 18.5% of the basic salary. This makes up EUR 4987.

Solidarity Levy

The Solidarity Levy is 6% of the basic salary. This makes up EUR 1617.

There are also four social security-related deductions.

Pension

The Pension Contribution is 10.10% of the basic salary. This adds up to EUR 2695.

The European Commission College members have much more generous pension guarantees compared to regular EU staff. You can read more about the regular pension benefits for staff of EU institutions.

Health insurance

The Health Insurance Contribution is 1.70% of the basic salary. This adds up to EUR 458.

The health insurance contribution makes the official eligible for the EU institutions health insurance scheme JSIS.

Accident coverage

The Accident Coverage Contribution is 0.10% of the basic salary. This adds up to EUR 27.

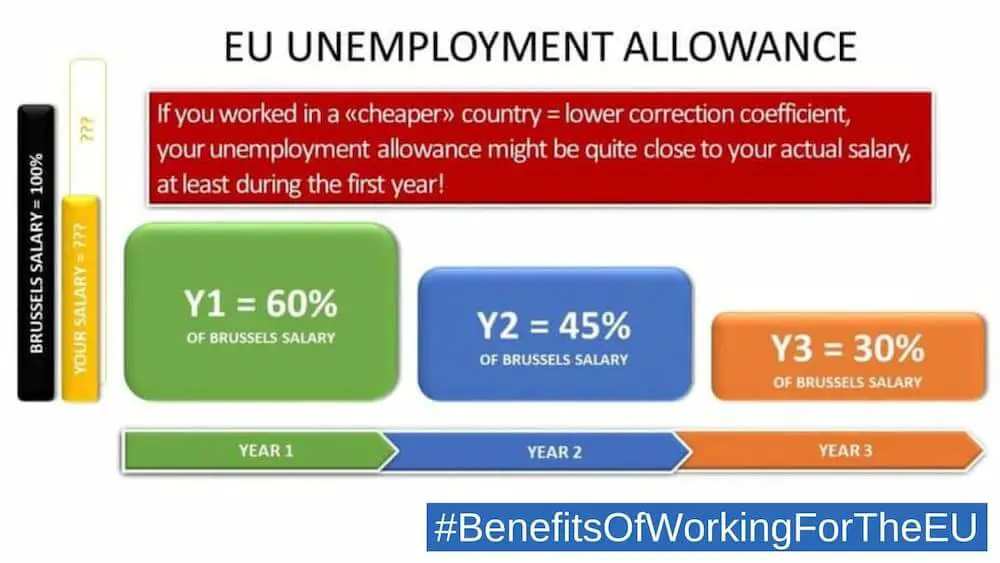

Unemployment insurance

The Unemployment Insurance Contribution is 0.81%. This adds up to EUR 218.

The European Commission College members have much more generous unemployment guarantees compared to regular EU staff. You can read more about the regular unemployment benefits for staff of EU institutions.

Background information

Basic salary coefficients for members of the College of European Commission

Entertainment allowance

Information about tax amounts and other salary deductions

For information about amounts of EU taxes, pension contributions, unemployment and other deductions see this document prepared by ECDC for candidates and staff. The same information applies to all EU institutions.

Image source: European Commission website