EU officials’ salaries are not subject to national taxes of EU member states. This is according to Protocol 7 on the privileges and immunities of the European Union, which is an annex to the Treaty on the Functioning of the European Union.

Officials and other servants of the Union shall be liable to a tax for the benefit of the Union on salaries, wages and emoluments paid to them by the Union, in accordance with the conditions and procedure laid down by the European Parliament and the Council, acting by means of regulations in accordance with the ordinary legislative procedure and after consultation of the institutions concerned. They shall be exempt from national taxes on salaries, wages and emoluments paid by the Union.

Article 12

However, EU officials pay a ‘Solidarity Levy’ of 6% and a ‘Community Tax’ that ranges between 8% and 45% of their ‘basic salary’.

If EU officials receive “outside income”, e.g., by renting out property in their home country, they will pay all the same taxes as other citizens of their tax residence country.

Besides these two taxes, EU officials also have a number of other deductions from their salaries:

- Pension contribution (~9,7% of their basic salary)

- Health insurance contribution (~1,70% of their basic salary)

- Accident cover (~0,10% of their basic salary)

- Unemployment insurance (~0,81% of their basic salary)

This article will explain how much is the Solidarity Levy and the Community Tax.

Curious about pay in EU institutions? Read “How much do EU officials earn?“

Solidarity Levy

For most EU officials, the Solidarity Levy is 6% of the basic salary.

The Solidarity Levy is 7% for officials in grade AD15, step 2, and above. This higher Solidarity Levy rate affects maybe a few hundred EU officials in the very highest EU jobs like Directors General of European Commission DGs.

Let’s take a very common position in the European Commission – an Administrator in grade 5. The basic monthly salary in grade AD5 is EUR 5453,02. This means that the person would pay a Solidarity Levy of EUR 327.18 from its monthly salary.

The Solidarity Levy is temporary measure that was introduced on 1 January 2014 and is supposed to end on 31 December 2023. It is not clear whether application of the Solidarity Levy will be extended.

Community Tax

The Community Tax ranges from 8% to 45% of an EU official’s basic salary.

The Community Tax is similar to income tax in EU countries.

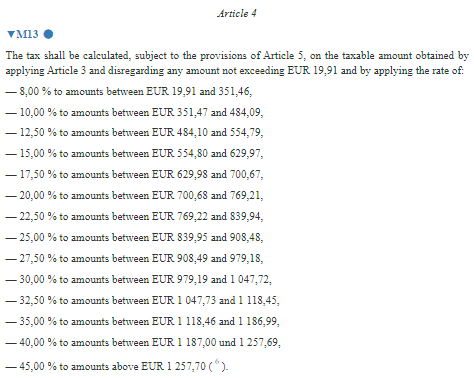

The formula for the Community Tax is included in this Regulation. The EUR values in the image below refer to the tax levied proportionally to the daily amount of basic salary.

If you assume that there are 22 working days in months, you get the following monthly Community Tax values:

- 8.00% tax on basic salaries between EUR 438.02 and 7,731.12

- 10.00% tax on basic salaries between EUR 7,731.34 and 10,649.98

- 12.50% tax on basic salaries between EUR 10,649.20 and 12,205.38

- 15.00% tax on basic salaries between EUR 12,206.60 and 13,859.34

- 17.50% tax on basic salaries between EUR 13,859.56 and 15,415.74

- 20.00% tax on basic salaries between EUR 15,414.96 and 16,922.62

- 22.50% tax on basic salaries between EUR 16,923.24 and 18,479.68

- 25.00% tax on basic salaries between EUR 18,481.90 and 19,986.56

- 27.50% tax on basic salaries between EUR 19,987.38 and 21,541.96

- 30.00% tax on basic salaries between EUR 21,543.38 and 23,045.84

- 32.50% tax on basic salaries between EUR 23,047.06 and 24,605.90

- 35.00% tax on basic salaries between EUR 24,607.12 and 26,153.78

- 40.00% tax on basic salaries between EUR 26,114.00 and 27,669.18

- 45.00% tax on basic salaries above EUR 27,669.40

Administrators effectively pay a Community Tax between 8% and 27.5% of their monthly basic salary.

Assistants effectively pay a Community Tax between 8% and 12.5% of their monthly basic salary.

Based on their basic salaries, only the European Commission President, Vice-Presidents and Commissioners pay the Community Tax in the higher brackets of 30-45%.

Community Tax for Administrators in 1st step of each grade from AD5 to AD16

You can find the full European Commission Salary Grid here. In the below table we have taken the first step in each grade of the Salary Grid for Administrators and calculated the proportional Community Tax amount.

| Grade | Monthly basic salary in step 1 | Community tax % | Community Tax in EUR |

|---|---|---|---|

| AD 16 | 21211.18 | 27.50% | 5833.07 |

| AD 15 | 18747.14 | 25.00% | 4686.79 |

| AD 14 | 16569.31 | 20.00% | 3313.86 |

| AD 13 | 14644.53 | 17.50% | 2562.79 |

| AD 12 | 12943.31 | 15.00% | 1941.50 |

| AD 11 | 11439.71 | 12.50% | 1429.96 |

| AD 10 | 10110.82 | 10.00% | 1011.08 |

| AD 9 | 8936.26 | 10.00% | 893.63 |

| AD 8 | 7898.16 | 10.00% | 789.82 |

| AD 7 | 6980.66 | 8.00% | 558.45 |

| AD 6 | 6169.72 | 8.00% | 493.58 |

| AD 5 | 5453.02 | 8.00% | 436.24 |

Community Tax for Assistants in 1st step of each grade from AST1 to AST11

You can find the full European Commission Salary Grid here. In the below table we have taken the first step in each grade of the Salary Grid for Assistants and calculated the proportional Community Tax amount.

| Grade | Monthly basic salary in step 1 | Community tax % | Community Tax in EUR |

|---|---|---|---|

| AST 11 | 11439.71 | 12.50% | 1429.96 |

| AST 10 | 10110.82 | 10.00% | 1011.08 |

| AST 9 | 8936.26 | 10.00% | 893.63 |

| AST 8 | 7898.16 | 10.00% | 789.82 |

| AST 7 | 6980.66 | 8.00% | 558.45 |

| AST 6 | 6169.72 | 8.00% | 493.58 |

| AST 5 | 5453.02 | 8.00% | 436.24 |

| AST 4 | 4819.56 | 8.00% | 385.56 |

| AST 3 | 4259.65 | 8.00% | 340.77 |

| AST 2 | 3764.84 | 8.00% | 301.19 |

| AST 1 | 3327.49 | 8.00% | 266.20 |

Do you have question or suggestion for this article? Please share in a comment below and let’s make this resource better for you and other readers!

3 responses to “Do EU officials pay tax?”

Hi, I was wondering what type of taxes contract agents (FGIV) pay? Or are contract agents just subject to national taxes? Thanks!

As a retired Belgian civil servant considering a job at the EU as a contract agent FGIII, there are several tax and pension-related questions:

1. Do you need to declare this EU income to the Belgian tax authorities?

2. Is this EU income considered as professional income under Belgian taxation?

3. What will be the impact on my Belgian civil servant pension?

Can you please help me with these questions?

Hi! This is very specific and as I’m not based in Belgium, I can’t answer the precise questions. However, what I would do is to try to consult AIACE, International Association of Former Staff of the European Union. Even if they require you to become a paid member, I believe it’s worth the fee as they would have encountered hundreds of similar cases and would know details. Give them a call and see what your options are!