This article shows how much Administrators in grade AD7 step 1 can expect to earn in the European Commission. The information directly applies also to the European Parliament, European Council, EU agencies and all other EU institutions. The article presents the full remuneration package: not only the basic salary, but also allowances and other benefits. It also shows the impact of location and the Correction Coefficient on your take-home pay.

Basic salary vs. full remuneration package

The monthly ‘basic salary’ for Administrators AD7 in the European Commission and other EU institutions ranges from EUR 6414 to 7258. The starting basic salary will always be the lower number, but you can get ‘reclassified’ or get promoted.

‘Reclassification‘ is the automatic advancement through the European Commission salary scales by one step every two years (see table below to assess the financial impact on your basic salary). ‘Promotion‘ based on good professional performance in the EU context means that you not only get a good evaluation in the annual ‘appraisal’ process, but are also made to skip several salary scale steps or even a grade at once. Promotion has the most significant impact on your income, if you remain in the same job.

At the same time, knowing your ‘basic salary’ in most cases does not tell you much about your final take-home pay. There are two reasons for this.

Firstly, the basic salary is supplemented by a number allowances. This is especially so if you have children, a spouse or/and are an expat.

Secondly, the country you are employed in has a significant impact on your total salary due to the ‘Correction Coefficient‘. Brussels is used as reference and there the Correction Coefficient is 100% of basic salary as quoted below. If you work for an EU agency in Scandinavia, your salary and allowances will upped by 18-31% to compensate for higher living costs. Conversely, if you will work for the EU in Bulgaria, you will get only 55% of what your Brussels colleague doing the same job gets.

Administrators’ remuneration by family and residence status

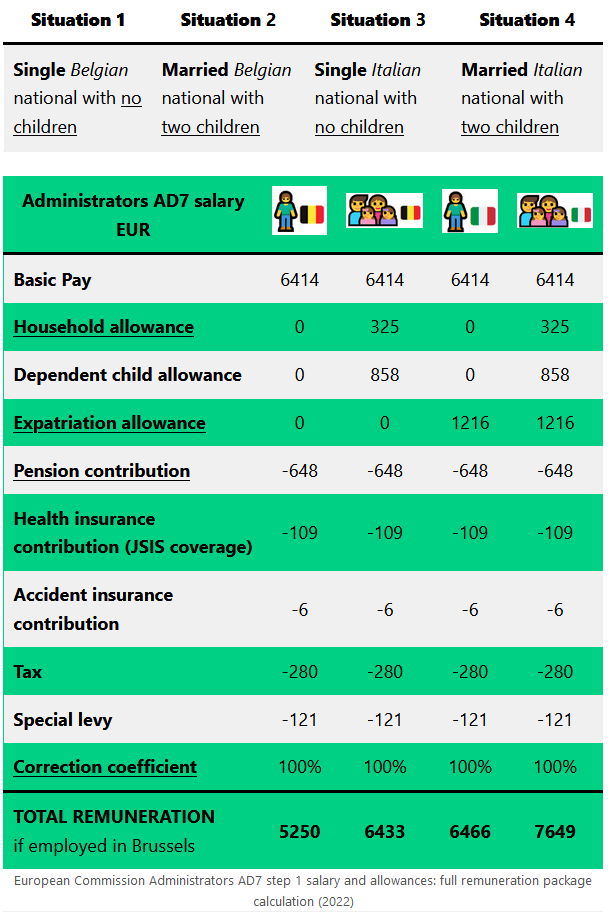

Below is a sample salary and take-home pay approximation of an Administrator in grade AD5 step 1 who is living in Brussels, Belgium, with four typical personal/family situations.

| Situation 1 | Situation 2 | Situation 3 | Situation 4 |

|---|---|---|---|

| Single Belgian national with no children | Married Belgian national with two children | Single Italian national with no children | Married Italian national with two children |

| Administrators AD7 salary EUR | ||||

|---|---|---|---|---|

| Basic Pay | 6414 | 6414 | 6414 | 6414 |

| Household allowance | 0 | 325 | 0 | 325 |

| Dependent child allowance | 0 | 858 | 0 | 858 |

| Expatriation allowance | 0 | 0 | 1216 | 1216 |

| Pension contribution | -648 | -648 | -648 | -648 |

| Health insurance contribution (JSIS coverage) | -109 | -109 | -109 | -109 |

| Accident insurance contribution | -6 | -6 | -6 | -6 |

| Tax | -280 | -280 | -280 | -280 |

| Special levy | -121 | -121 | -121 | -121 |

| Correction coefficient | 100% | 100% | 100% | 100% |

| TOTAL REMUNERATION if employed in Brussels | 5250 | 6433 | 6466 | 7649 |

N.B. These calculations are only indicative as they are based on public sources. Only your institution’s HR department will be able to calculate a 100% accurate figure once you provide all necessary documents.

On top of the above, any children would either be guaranteed a place in the local European School, or an Education Allowance for each child. The expat family would also get around 1000 EUR annually per family member as a Travel Grant considering the distance to Rome.

European Commission 2022 salary scale for AdministratorsAST7

| Grade | Step 1 | Step 2 | Step 3 | Step 4 | Step 5 |

|---|---|---|---|---|---|

| 8 | 7 257,53 | 7 562,50 | 7 880,28 | 8 099,53 | 8 211,43 |

| 7 | 6 414,44 | 6 683,99 | 6 964,85 | 7 158,63 | 7 257,53 |

| 6 | 5 669,29 | 5 907,53 | 6 155,76 | 6 327,03 | 6 414,44 |

Impact of Correction Coefficient on AD7 basic pay

The below table shows you the actual Administrators AD7 basic pay according to the correction coefficient by location of your institution. You should also read a dedicated article about the Correction Coefficient to understand the details.

| Location | EU institution | Correction Coefficient | Adjusted Basic Salary EUR |

|---|---|---|---|

| Amsterdam, Netherlands | EMA | 111.4 | 7145 |

| Barcelona, Spain | F4E | 96.3 | 6177 |

| Berlin, Germany | EU Delegation | 101.4 | 6504 |

| Bilbao, Spain | EU-OSHA | 96.3 | 6177 |

| Bratislava, Slovakia | ELA | 79.9 | 5125 |

| Brussels, Belgium | European Commission, European Parliament, European Council, EDA, SRB | 100 | 6414 |

| Bucharest, Romania | ECITRCC | 68.5 | 4394 |

| Budapest, Hungary | CEPOL, EIT | 76.1 | 4881 |

| Cologne, Germany | EASA | 96.9 | 6215 |

| Copenhagen, Denmark | EEA | 134.2 | 8608 |

| Dublin, Ireland | EUROFOUND | 133.6 | 8569 |

| Frankfurt am Main, Germany | ECB, EIOPA | 96.9 | 6215 |

| Hague, Netherlands | Eurojust, Europol | 111.4 | 7145 |

| Helsinki, Finland | ECHA | 118.6 | 7607 |

| Heraklion, Greece | ENISA | 85.2 | 5465 |

| Karlsruhe, Germany | JRC | 96.9 | 6215 |

| Lefkosia, Cyprus | EU Delegation | 82.2 | 5272 |

| Lisbon, Portugal | EMSA, EMCDDA | 91.4 | 5862 |

| Ljubljana, Slovenia | ACER | 84.9 | 5445 |

| Luxembourg City, Luxembourg | European Commission, Eurostat, CDT, Court of Auditors | 100 | 6414 |

| Madrid, Spain | EU Delegation | 96.3 | 6177 |

| Munich, Germany | n/a | 113.4 | 7273 |

| Parma, Italy | EFSA | 91.2 | 5850 |

| Paris, France | EBA, ESMA | 119.9 | 7690 |

| Prague, Czechia | EGSA | 88.1 | 5651 |

| Riga, Latvia | BEREC | 80 | 5131 |

| Rome, Italy | EU Delegation | 95.2 | 6106 |

| Sofia, Bulgaria | EU Delegation | 61.7 | 3957 |

| Stockholm, Sweden | ECDC | 130.3 | 8357 |

| Tallinn, Estonia | eu-LISA | 86.3 | 5535 |

| Thessaloniki, Greece | CEDEFOP | 85.2 | 5465 |

| Turin, Italy | ETF | 91.2 | 5850 |

| Valletta, Malta | EUAA | 94 | 6029 |

| Varese, Italy | n/a | 91.2 | 5850 |

| Valenciennes and Lille, France | ERA | 119.9 | 7690 |

| Vienna, Austria | FRA | 109.6 | 7030 |

| Vigo, Spain | EFCA | 96.3 | 6177 |

| Vilnius, Lithuania | EIGE | 80.1 | 5138 |

| Warsaw, Poland | Frontex | 70.6 | 4528 |

| Zagreb, Croatia | EU Delegation | 78.3 | 5022 |

Take into account that your allowances will also be adjusted by the Correction Coefficient. If you will work not in Brussels, but in another EU location, you should multiply the grand total values in the “scenarios table” to get the actual approximate figure.

RELATED ARTICLES:

* Salary of Administrators AD5

* Salary of Administrators AD6

* Salary of Administrators AD8

* Salary of Administrators AD9

* Salary of Administrators AD10

* Salary of Administrators AD11

* Salary of Administrators AD12

* Salary of Administrators AD13

* Salary of Administrators AD14

* Salary of Administrators AD15

* Salary of Administrators AD16

Allowances and other benefits for EU institutions staff

Several allowances and other benefits can quite significantly boost an EU official’s income. This largely depends on whether the person is an expat and has a spouse and/or children. When considering a job at an EU institution, people too often do not take these benefits into account. Important – these benefits are available to Administrators in grades AD 5-16, Assistants in grades AST 1-11, Secretaries and Clerks in grades AST/SC 1-6, and Contract Agents in grades FG I-IV.

- Travel costs on taking up duties

- Daily subsistence allowance (during probation period)

- Installation allowance and coverage of removal costs (one-time payments)

- Expatriation allowance or Foreign Residence allowance

- Household allowance

- Dependent child allowance

- European School enrollment for children or Education allowance if there is no local EU school

- Healthcare costs reimbursement to a level of 80-85% through the EU’s Joint Sickness Insurance Scheme (JSIS) for the employee and any direct family members and dependents. 100% reimbursement of costs in case of a serious illness

- Accident insurance

- Annual travel compensation

- Birth grant

- Parental leave

- Unemployment allowance

- Removal expenses when leaving your home country and again when leaving your EU institution

- EU pension, survivors and orphan’s pensions, invalidity allowance

- Lump sum payments in case of permanent invalidity or death

- Lump sum funeral expenses, up to EUR 2350

Visuals for social sharing

Sources

This article is based on the European Commission Staff Regulations and other publicly available information such as EU institutions’ vacancy announcements. As the EU legal documents and even information on the various websites is hard to understand, this article is one from a series that tries to make information about employment in the European Commission and other EU institutions more accessible.

Do you have question or suggestion for this article? Please share in a comment below and let’s make this resource better for you and other readers!

11 responses to “What is the salary of Administrators AD 7?”

It would be nice to have all the data updated; in particular the basic monthly salaries for each grade and step in function groups AD and AST applicable from 1 July 2023.

Fair point. While I get around to that, you can check the current basic salaries in this article: https://euemployment.eu/european-commission-salary-grid/

Can citizens of non-EU states apply for jobs in EU institutions? If so, what caveats and restrictions apply? Thank you.

Hi! In general, no. However, some SNE positions are availabe to EU candidate countries, e.g., Western Balkans. There are also some EU agencies where non-EU states like Norway contribute funding. I believe that in these cases the nationals of the respective countries have some employment opportunities, but I haven’t looked in detail into this.

I was offered a contract as temporary agent AD7 step2. From what I understand the tax deduction is levied progressively at a rate of between 8% to

45 % of the taxable portion of the salary. Would somebody know what rate applies to AD7, is it 8% or more? Many thanks.

Hi! I cannot tell you the exact tax rate, but it will be closer to 8% rather than 45%. The higher rates almost exclusively apply to the top positions like AD14-16. See article 4 of this regulation. You might be able to calculate the applicable rate based on the information provided there.

Tax (tax, Special levy, …) is already mentioned in the overview -> is the final number 5219 (single person from belgium) still taxable in home country?

What other post should be deducted from the final number?

Salaries in EU institutions are not taxed on the national level.

Indeed, the calculation (at least for scenario 3) is wrong, it is around 5500 € not 6200 €

This calculation in at least scenario 3 is wrong! The result is 5871 not 6186 euros!

Hi there,

Why do the taxes go down where there is a child allowance?

Many thanks,

John