This article provides estimated net salaries at CdT, the Translation Centre for the Bodies of the European Union, located in Luxembourg.

The Translation Centre for the Bodies of the European Union provides translation and related services to other decentralised EU agencies. It also serves European Commission and other EU institutions that have their own translation services when their translation services are overloaded. CdT was established in 1994.

Most EU institutions, including CdT, do a notoriously poor job in communicating their salaries. Very often EU agencies and other EU institutions just indicate the gross basic pay without deductions and allowances, and quite many do not adjust it by the Correction Coefficient which can have a significant impact on an employee’s net take-home pay.

This makes it very hard for people without experience in the EU system to understand one’s actual future income, and is a hindrance for quite many people already employed in EU institutions that consider a career change.

This article series will seek to address the lack of information on actual net salaries in EU agencies and other institutions.

As usual for this type of information, bear in mind the caveat that your precise salary can be calculated only by the EU institution’s HR department that knows your particular professional and personal circumstances.

The salaries below are presented according to four typical personal/family situations of future employees:

- by type of contract (Contract Agent, Administrator, Assistant, Secretary and Clerk) and

- function group (FGI-FGIV, AD5-AD16, AST1-AST11, AST/SC1-AST/SC6).

The mentioned personal/family situations are:

| Situation 01 | Situation 02 | Situation 03 | Situation 04 |

|---|---|---|---|

| Single local with no children | Married local with two children | Single expat with no children | Married expat with two children |

To get an idea of your actual salary at CdT, you should look at the right cell in one of the four columns in the tables below that best corresponds to your personal/family situation. In calculating these values we have summed up not only the basic salary, but also the applicable allowances and deductions: household allowance, child allowances, expatriation allowance, pension contribution, sickness, accident and unemployment insurance, as well as community tax. All values in the last four columns are also adjusted by the relevant European Commission’s Correction Coefficient, so they present a realistic approximation of take-home pay/full remuneration package calculation.

The information below gives you a realistic estimate of what you can expect to earn at CdT. People interested in working for EU institutions often only look up the basic pay for their type of contract and grade. This is a mistake as the actual net salary can differ up or down quite a bit, compared to the basic salary.

If you want to understand what elements constitute the full salary package in the EU institutions and their weight in the total remuneration calculation, please read the article applicable to your type of contract: Contract Agents, Administrators, Assistants, Secretaries and Clerks.

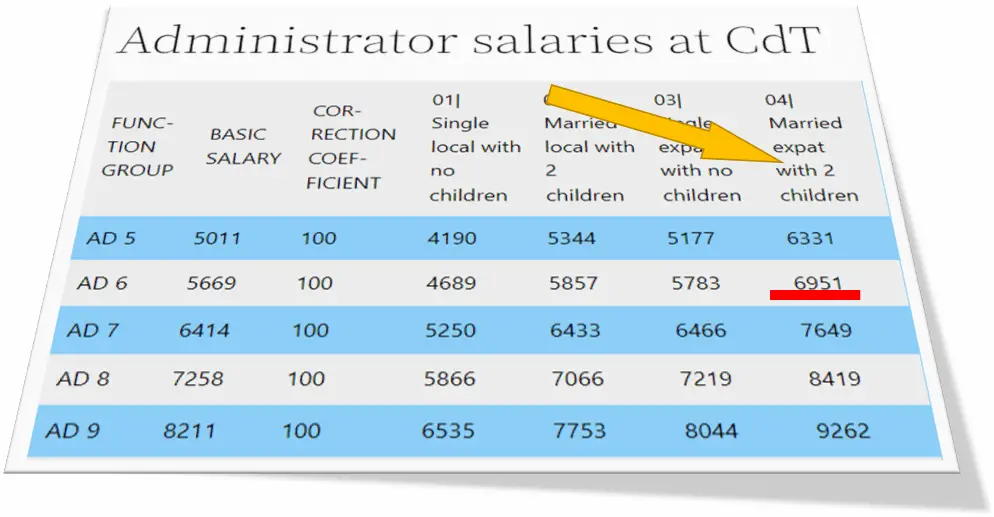

How to read the tables

Here’s an explanation of how to read the tables below.

Let’s assume that you have applied for an AD6 Administrator’s vacancy in CdT. You are an Italian national (any nationality except Luxembourgish fits here) with a spouse and two children. From the table below you can deduct that your basic salary without any adjustments would be EUR 5669, however, by working for CdT in Luxembourg, your net take-home remuneration package would be around EUR 6951. A Luxembourg national with a similar family situation would earn EUR 5857.

Contract Agent salaries at CdT

| FUNC-TION GROUP | BASIC SALARY | COR-RECTION COEF-FICIENT | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| FG I step 1 | 2128 | 100 | 1876 | 2973 | 2458 | 3555 |

| FG II step 4 | 2211 | 100 | 1939 | 3038 | 2521 | 3620 |

| FG III step 8 | 2831 | 100 | 2466 | 3577 | 3096 | 4207 |

| FG IV step 13 | 3624 | 100 | 3094 | 4214 | 3847 | 4974 |

Administrator salaries at CdT

| FUNC-TION GROUP | BASIC SALARY | COR-RECTION COEF-FICIENT | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| AD 5 | 5011 | 100 | 4190 | 5344 | 5177 | 6331 |

| AD 6 | 5669 | 100 | 4689 | 5857 | 5783 | 6951 |

| AD 7 | 6414 | 100 | 5250 | 6433 | 6466 | 7649 |

| AD 8 | 7258 | 100 | 5866 | 7066 | 7219 | 8419 |

| AD 9 | 8211 | 100 | 6535 | 7753 | 8044 | 9262 |

| AD 10 | 9291 | 100 | 7253 | 8493 | 8938 | 10178 |

| AD 11 | 10512 | 100 | 8022 | 9287 | 9906 | 11171 |

| AD 12 | 11893 | 100 | 8836 | 10128 | 10946 | 12238 |

| AD 13 | 13457 | 100 | 9636 | 10960 | 12001 | 13325 |

| AD 14 | 15225 | 100 | 10197 | 11569 | 12955 | 14327 |

| AD 15 | 17227 | 100 | 11149 | 12562 | 14249 | 15662 |

| AD 16 | 19491 | 100 | 12134 | 13595 | 15617 | 17078 |

Assistant salaries at CdT

| FUNC-TION GROUP | BASIC SALARY | COR-RECTION COEF-FICIENT | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| AST 1 | 3058 | 100 | 2683 | 3799 | 3351 | 4467 |

| AST 2 | 3459 | 100 | 2979 | 4102 | 3712 | 4835 |

| AST 3 | 3914 | 100 | 3343 | 4476 | 4151 | 5284 |

| AST 4 | 4429 | 100 | 3741 | 4884 | 4632 | 5775 |

| AST 5 | 5011 | 100 | 4190 | 5344 | 5177 | 6331 |

| AST 6 | 5669 | 100 | 4689 | 5857 | 5783 | 6951 |

| AST 7 | 6414 | 100 | 5250 | 6433 | 6466 | 7649 |

| AST 8 | 7258 | 100 | 5866 | 7066 | 7219 | 8419 |

| AST 9 | 8211 | 100 | 6535 | 7753 | 8044 | 9262 |

| AST 10 | 9291 | 100 | 7253 | 8493 | 8938 | 10178 |

| AST 11 | 10512 | 100 | 8022 | 9287 | 9906 | 11171 |

Secretaries and Clerks salaries at CdT

| FUNC-TION GROUP | BASIC SALARY | COR-RECTION COEF-FICIENT | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| AST/SC 1 | 2745 | 100 | 2392 | 3508 | 3022 | 4138 |

| AST/SC 2 | 3106 | 100 | 2711 | 3827 | 3379 | 4495 |

| AST/SC 3 | 3514 | 100 | 2973 | 4100 | 3733 | 4860 |

| AST/SC 4 | 3976 | 100 | 3373 | 4506 | 4181 | 5314 |

| AST/SC 5 | 4499 | 100 | 3796 | 4939 | 4687 | 5830 |

| AST/SC 6 | 5090 | 100 | 4269 | 5423 | 5256 | 6410 |

Allowances and other benefits for EU institutions staff

Several allowances and other benefits can quite significantly boost an EU official’s income. This largely depends on whether the person is an expat and has a spouse and/or children. When considering a job at an EU institution, people too often do not take these benefits into account. Important – these benefits are available to Administrators in grades AD 5-16, Assistants in grades AST 1-11, Secretaries and Clerks in grades AST/SC 1-6, and Contract Agents in grades FG I-IV.

- Travel costs on taking up duties

- Daily subsistence allowance (during probation period)

- Installation allowance and coverage of removal costs (one-time payments)

- Expatriation allowance or Foreign Residence allowance

- Household allowance

- Dependent child allowance

- European School enrollment for children or Education allowance if there is no local EU school

- Healthcare costs reimbursement to a level of 80-85% through the EU’s Joint Sickness Insurance Scheme (JSIS) for the employee and any direct family members and dependents. 100% reimbursement of costs in case of a serious illness

- Accident insurance

- Annual travel compensation

- Birth grant

- Parental leave

- Unemployment allowance

- Removal expenses when leaving your home country and again when leaving your EU institution

- EU pension, survivors and orphan’s pensions, invalidity allowance

- Lump sum payments in case of permanent invalidity or death

- Lump sum funeral expenses, up to EUR 2350

Do you have question or suggestion for this article? Please share in a comment below and let’s make this resource better for you and other readers!