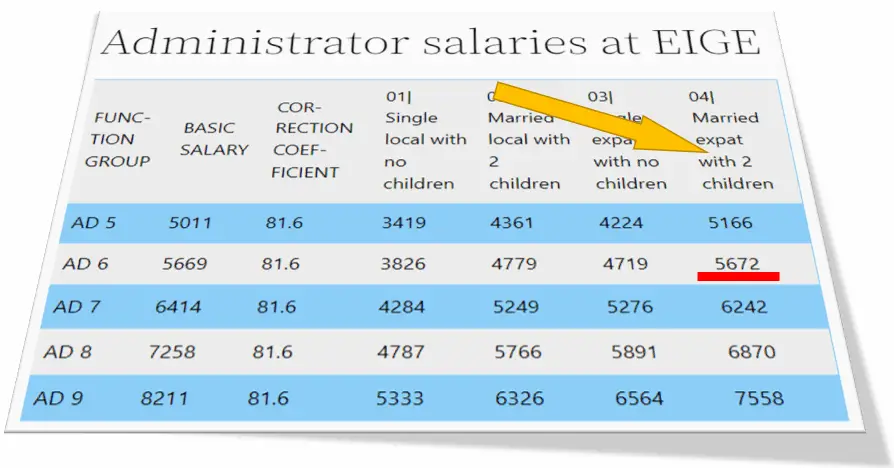

This article provides approximate net salaries at EIGE, the European Gender Equality Institute, located in Vilnius, Lithuania.

EIGE is an EU agency dealing with issues related to gender equality. It works on promotion of gender equality through collecting and producing resources on gender mainstreaming and other tools and instruments. EIGE is most widely known for its production of the Gender Equality Index. Check out the EIGE factsheet if consider working there or are preparing for an interview.

Most EU institutions, including EIGE, do a poor job in communicating their salary scales as they often indicate just the basic pay and little other detail, and quite many even fail to adjust it by the applicable Correction Coefficient. This is not helpful for people without experience in the EU system, and a hindrance for quite many staff members that consider changing their positions as this makes it really difficult to understanding a person’s future income. This article series will seek to address the lack of information on actual net salaries in EU institutions.

The salaries below are presented according to four typical personal/family situations of future employees:

- by type of contract (Contract Agent, Administrator, Assistant, Secretary and Clerk) and

- function group (FGI-FGIV, AD5-AD16, AST1-AST11, AST/SC1-AST/SC6).

The mentioned personal/family situations are:

| Situation 01 | Situation 02 | Situation 03 | Situation 04 |

|---|---|---|---|

| Single local with no children | Married local with two children | Single expat with no children | Married expat with two children |

The European Commission Correction Coefficient for Lithuania is

81.6

The salaries in the tables below have been adjusted by this value to give you a realistic idea of net pay based on your personal situation.

To get an idea of your actual salary at EIGE, you should look at the right cell in one of the four columns in the tables below that best corresponds to your personal/family situation. In calculating these values we have summed up not only the basic salary, but also the applicable allowances and deductions: household allowance, child allowances, expatriation allowance, pension contribution, sickness, accident and unemployment insurance, as well as community tax. All values in the last four columns are also adjusted by the European Commission’s Correction Coefficient for Lithuania, so they present a realistic approximation of take-home pay/full remuneration package calculation.

As usual in these types of articles, there is the caveat that your precise salary can only be calculated by the EU institution’s HR department that knows your particular professional and personal circumstances.

The information below gives you a realistic estimate of what you can expect to earn at EIGE. People interested in working for EU institutions often only look up the basic pay for their type of contract and grade. This is a mistake as the actual net salary can differ up or down quite a bit, compared to the basic salary.

If you want to understand what elements constitute the full salary package in the EU institutions and their weight in the total remuneration calculation, please read the article applicable to your type of contract: Contract Agents, Administrators, Assistants, Secretaries and Clerks.

How to read the tables

Here’s an explanation of how to read the tables below.

Let’s assume that you have applied for an AD6 Administrator’s vacancy in EIGE. You are a Belgian national (any nationality except Lithuanian fits here) with a spouse and two children. From the table below you can deduct that your basic salary without any adjustments would be EUR 5669, however, by working for EIGE in Vilnius, your net take-home remuneration package would be around EUR 4779. A Lithuanian national with a similar family situation would earn EUR 5672.

Contract Agent salaries at EIGE

| FUNC-TION GROUP | BASIC SALARY | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| FG I step 1 | 2128 | 1531 | 2426 | 2006 | 2901 |

| FG II step 4 | 2211 | 1582 | 2479 | 2057 | 2954 |

| FG III step 8 | 2831 | 2012 | 2919 | 2526 | 3433 |

| FG IV step 13 | 3624 | 2525 | 3439 | 3139 | 4059 |

Administrator salaries at EIGE

| FUNC-TION GROUP | BASIC SALARY | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| AD 5 | 5011 | 3419 | 4361 | 4224 | 5166 |

| AD 6 | 5669 | 3826 | 4779 | 4719 | 5672 |

| AD 7 | 6414 | 4284 | 5249 | 5276 | 6242 |

| AD 8 | 7258 | 4787 | 5766 | 5891 | 6870 |

| AD 9 | 8211 | 5333 | 6326 | 6564 | 7558 |

| AD 10 | 9291 | 5918 | 6930 | 7293 | 8305 |

| AD 11 | 10512 | 6546 | 7578 | 8083 | 9116 |

| AD 12 | 11893 | 7210 | 8264 | 8932 | 9986 |

| AD 13 | 13457 | 7863 | 8943 | 9793 | 10873 |

| AD 14 | 15225 | 8321 | 9440 | 10571 | 11691 |

| AD 15 | 17227 | 9098 | 10251 | 11627 | 12780 |

| AD 16 | 19491 | 9901 | 11094 | 12743 | 13936 |

Assistant salaries at EIGE

| FUNC-TION GROUP | BASIC SALARY | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| AST 1 | 3058 | 2189 | 3100 | 2734 | 3645 |

| AST 2 | 3459 | 2431 | 3347 | 3029 | 3945 |

| AST 3 | 3914 | 2728 | 3652 | 3387 | 4312 |

| AST 4 | 4429 | 3053 | 3985 | 3780 | 4712 |

| AST 5 | 5011 | 3419 | 4361 | 4224 | 5166 |

| AST 6 | 5669 | 3826 | 4779 | 4719 | 5672 |

| AST 7 | 6414 | 4284 | 5249 | 5276 | 6242 |

| AST 8 | 7258 | 4787 | 5766 | 5891 | 6870 |

| AST 9 | 8211 | 5333 | 6326 | 6564 | 7558 |

| AST 10 | 9291 | 5918 | 6930 | 7293 | 8305 |

| AST 11 | 10512 | 6546 | 7578 | 8083 | 9116 |

Secretaries and Clerks salaries at EIGE

| FUNC-TION GROUP | BASIC SALARY | 01| Single local with no children | 02| Married local with 2 children | 03| Single expat with no children | 04| Married expat with 2 children |

| AST/SC 1 | 2745 | 1952 | 2863 | 2466 | 3377 |

| AST/SC 2 | 3106 | 2212 | 3123 | 2757 | 3668 |

| AST/SC 3 | 3514 | 2426 | 3346 | 3046 | 3966 |

| AST/SC 4 | 3976 | 2752 | 3677 | 3412 | 4336 |

| AST/SC 5 | 4499 | 3098 | 4030 | 3825 | 4757 |

| AST/SC 6 | 5090 | 3484 | 4425 | 4289 | 5231 |

Allowances and other benefits for EU institutions staff

Several allowances and other benefits can quite significantly boost an EU official’s income. This largely depends on whether the person is an expat and has a spouse and/or children. When considering a job at an EU institution, people too often do not take these benefits into account. Important – these benefits are available to Administrators in grades AD 5-16, Assistants in grades AST 1-11, Secretaries and Clerks in grades AST/SC 1-6, and Contract Agents in grades FG I-IV.

- Travel costs on taking up duties

- Daily subsistence allowance (during probation period)

- Installation allowance and coverage of removal costs (one-time payments)

- Expatriation allowance or Foreign Residence allowance

- Household allowance

- Dependent child allowance

- European School enrollment for children or Education allowance if there is no local EU school

- Healthcare costs reimbursement to a level of 80-85% through the EU’s Joint Sickness Insurance Scheme (JSIS) for the employee and any direct family members and dependents. 100% reimbursement of costs in case of a serious illness

- Accident insurance

- Annual travel compensation

- Birth grant

- Parental leave

- Unemployment allowance

- Removal expenses when leaving your home country and again when leaving your EU institution

- EU pension, survivors and orphan’s pensions, invalidity allowance

- Lump sum payments in case of permanent invalidity or death

- Lump sum funeral expenses, up to EUR 2350

Do you have question or suggestion for this article? Please share in a comment below and let’s make this resource better for you and other readers!