Key Takeaways

- ‘Basic salary’ doesn’t tell the whole story. Total take-home pay in EU institutions depends on multiple factors.

- Employment rules are uniform across not only the European Commission, European Parliament, European Council, but all 76 EU institutions.

- EU jobs are competitive not only because of the salaries, but the many other benefits.

Media often portray the EU institutions as if everyone working in them is drowning in money. Indeed, the top EU jobs are lucrative hovering around the 25 000 EUR per month mark with extra perks.

However, for the majority of EU employees their salaries and other benefits are significantly lower and depend on the type of contract you have and multiple other factors, e.g., employment duration and seniority of the post. Of course, they are by no means low compared to most EU countries’ average pay levels and come with additional allowances and other benefits.

This article provides an overview of what a future Administrator, Assistant (‘fonctionnaire’ in French) and a Contract Agent (‘agent contractuel’ in French) at the European Commission is entitled to – the basic salary, allowances and actual take-home pay, as well as health insurance, pension rights et cetera.

This article applies to the European Commission, European Parliament, European Council, EU Agencies, and other EU institutions, as these rules are applied uniformly across the “EU system”. The article also does not cover such staff groups as Seconded National Experts or SNEs, interims, nor trainees as these have their separate employment conditions and rules.

You might also want to read these articles:

* How to get a job in an EU agency?

* Types of jobs in EU institutions

Information covered in this article comes from public sources, mainly the Staff Regulations and various vacancy announcements by EU institutions. However, most people struggle with ‘legalese’ in these documents, that makes it hard to comprehend not only what is the actual basic salary, but also the actual take-home pay. Hence, I have created this guide, which is based on my experience of working for the EU institutions.

I wish I would have had something like this resource before starting out on my career in EU jobs. If you know someone who’s interested in working for the “institutions”, share the article with them to, hopefully, motivate the person to apply for their first vacancy call and not to give up after the first unsuccessful ‘concours’.

How much will you make in a job at an EU institution?

For people who are contemplating an EU job and even fresh recruits, it is often hard to understand what the final salary will look like.

People often focus only on the ‘basic salary’, however, the amount one gets in their bank account will depend on at least five other factors besides the advertised basic salary:

- Type of contract: administrator, assistant, secretary/clerk, contract agent, seconded national expert and some more “exotic” jobs like a special adviser.

- Your grade and step.

- Relevant allowances and other payments.

- EU social security contributions and other deductions.

- Adjusting it all by the relevant Correction Coefficient.

There are a number of other advantages that make an EU job quite attractive in the long run, especially if people are thinking about their pensions or health care coverage.

Basic salary

The salaries of EU employees are strictly regulated and there are clear brackets for each category and sub-category of employees. Below is an overview of the so-called salary scales for each of the main four groups of EU institutions employees:

- Administrators (AD 5 to AD 16)

- Assistants (AST 1 to AST 11)

- Secretaries and clerks (AST/SC 1-6)

- Contract Agents (FG I to FG IV)

Your basic salary is adjusted annually according to inflation and purchasing power in your EU country of employment, ensuring parity with living costs and the general labour market. Furthermore, if you work for an EU institution outside of Belgium or Luxembourg, your salary is subject to the Correction Coefficient, which accounts for the cost of living in your specific country.

Salaries of Administrators (AD) and Assistants (AST)

Officials – Administrators and Assistants – (in French – ‘fonctionnaire’) of the European Commission is the EU staff category that comes to most people’s minds when thinking about EU jobs. These are the people in most senior positions and are best paid employees of EU institutions (except the political appointments like the EU Commissioners and their team members).

Below is an overview of the monthly ‘basic salaries’ for Administrators and Assistants. Values in the table vary slightly from year to year, but they will give you a rather good idea of the income level.

Importantly, one has to remember that the basic salary can deviate significantly from your take-home pay amount due to the various allowances you might be entitled to, or if you are working in an EU country where the Correction Coefficient is significantly higher/lower compared to Brussels.

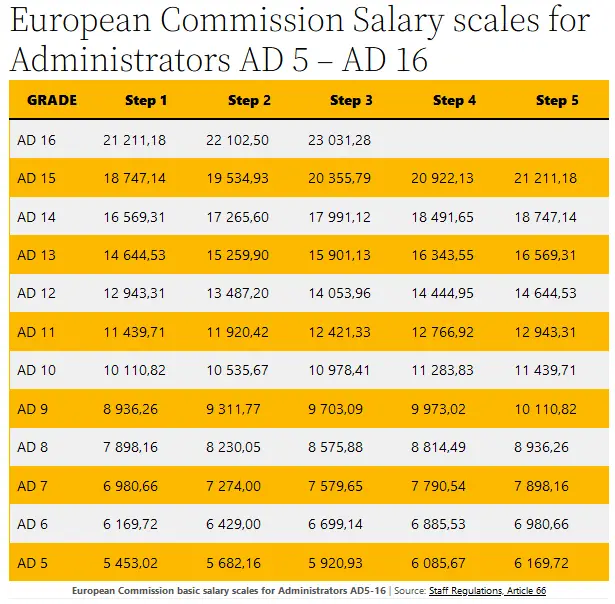

The below table shows the monthly basic salary for Administrators (AD) in the European Commission and all other EU institutions, ranging from grade AD 5 to AD 16. Keep in mind that your actual take-home pay may vary, as it can be affected by allowances and the Correction Coefficient in your country of employment.

European Commission Salary scales for Administrators AD 5 – AD 16

| GRADE | Step 1 | Step 2 | Step 3 | Step 4 | Step 5 |

|---|---|---|---|---|---|

| AD 16 | 21 211,18 | 22 102,50 | 23 031,28 | ||

| AD 15 | 18 747,14 | 19 534,93 | 20 355,79 | 20 922,13 | 21 211,18 |

| AD 14 | 16 569,31 | 17 265,60 | 17 991,12 | 18 491,65 | 18 747,14 |

| AD 13 | 14 644,53 | 15 259,90 | 15 901,13 | 16 343,55 | 16 569,31 |

| AD 12 | 12 943,31 | 13 487,20 | 14 053,96 | 14 444,95 | 14 644,53 |

| AD 11 | 11 439,71 | 11 920,42 | 12 421,33 | 12 766,92 | 12 943,31 |

| AD 10 | 10 110,82 | 10 535,67 | 10 978,41 | 11 283,83 | 11 439,71 |

| AD 9 | 8 936,26 | 9 311,77 | 9 703,09 | 9 973,02 | 10 110,82 |

| AD 8 | 7 898,16 | 8 230,05 | 8 575,88 | 8 814,49 | 8 936,26 |

| AD 7 | 6 980,66 | 7 274,00 | 7 579,65 | 7 790,54 | 7 898,16 |

| AD 6 | 6 169,72 | 6 429,00 | 6 699,14 | 6 885,53 | 6 980,66 |

| AD 5 | 5 453,02 | 5 682,16 | 5 920,93 | 6 085,67 | 6 169,72 |

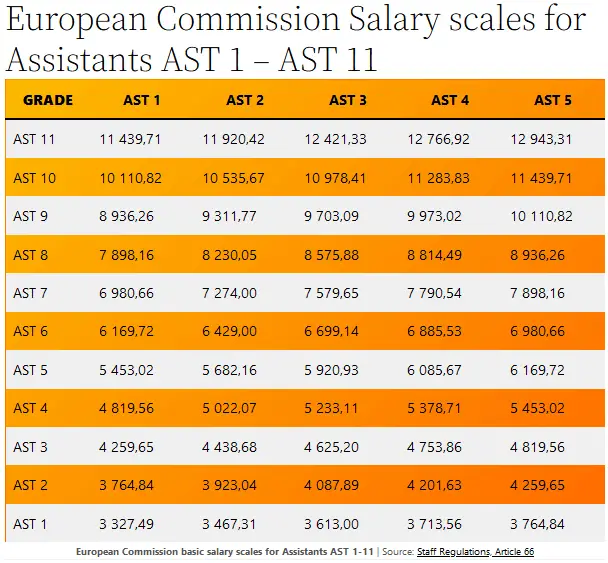

The following table presents the monthly basic salary for Assistants (AST) in the European Commission and all other EU institutions, ranging from grade AST 1 to AST 11.

European Commission Salary scales for Assistants AST 1 – AST 11

| GRADE | AST 1 | AST 2 | AST 3 | AST 4 | AST 5 |

|---|---|---|---|---|---|

| AST 11 | 11 439,71 | 11 920,42 | 12 421,33 | 12 766,92 | 12 943,31 |

| AST 10 | 10 110,82 | 10 535,67 | 10 978,41 | 11 283,83 | 11 439,71 |

| AST 9 | 8 936,26 | 9 311,77 | 9 703,09 | 9 973,02 | 10 110,82 |

| AST 8 | 7 898,16 | 8 230,05 | 8 575,88 | 8 814,49 | 8 936,26 |

| AST 7 | 6 980,66 | 7 274,00 | 7 579,65 | 7 790,54 | 7 898,16 |

| AST 6 | 6 169,72 | 6 429,00 | 6 699,14 | 6 885,53 | 6 980,66 |

| AST 5 | 5 453,02 | 5 682,16 | 5 920,93 | 6 085,67 | 6 169,72 |

| AST 4 | 4 819,56 | 5 022,07 | 5 233,11 | 5 378,71 | 5 453,02 |

| AST 3 | 4 259,65 | 4 438,68 | 4 625,20 | 4 753,86 | 4 819,56 |

| AST 2 | 3 764,84 | 3 923,04 | 4 087,89 | 4 201,63 | 4 259,65 |

| AST 1 | 3 327,49 | 3 467,31 | 3 613,00 | 3 713,56 | 3 764,84 |

Detailed overviews of salaries and other benefits of Administrators AD5-16 and Assistants AST1-11

* Salary of Administrators AD5

* Salary of Administrators AD6

* Salary of Administrators AD7

* Salary of Administrators AD8

* Salary of Administrators AD9

* Salary of Administrators AD10

* Salary of Administrators AD11

* Salary of Administrators AD12

* Salary of Administrators AD13

* Salary of Administrators AD14

* Salary of Administrators AD15

* Salary of Administrators AD16

Required periods of previous work experience for Administrators and Assistants

Length of previous working period has a significant on employment in EU institutions. You may not start working in a particular grade if you do not yet have the necessary number of years worked.

For administrators grades AD5, AD6, AD7, AD8 are considered as ‘entry grades’. You have to have the following number of years of professional experience to qualify for a particular grade:

- AD5 requires 0 years of previous professional experience.

- AD6 requires 3 years of previous professional experience.

- AD7 requires 6 years of previous professional experience.

- AD8 requires 9 years of previous professional experience.

- AD9 and AD10 requires 12 years of previous professional experience.

- AD11 and AD12 requires 15 years of previous professional experience.

There are the following additional limitations on advancement from one grade to the next:

For Assistants grades AST1, AST2, AST3, and AST4 are considered ‘entry grades’. Each Assistants’ grade requires the following work experience length:

- AST1 requires 0 years of previous professional experience.

- AST2 requires 3 years of previous professional experience.

- AST3 requires 6 years of previous professional experience.

- AST4 requires 9 years of previous professional experience.

It is Ok to be an ‘Assistant’!

You shouldn’t shy away from AST or Assistant’s positions. Unless you are literally hired for a position of a secretary, these usually are not low-level ‘assistants’ to other EU officials. Rather, the title of AST or ‘assistant’ is reserved for jobs of a more technical nature such as linguists, building management, or ICT specialists, but can very often be similar to AD posts. As an example, as an Assistant with a salary of 8000+ euros per month, you actually might manage a large group of laywer-linguists or be a senior IT architecture specialist. Yes, sometimes EU rules and naming conventions are weird.

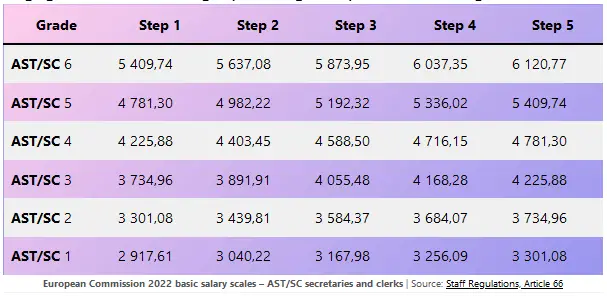

Salaries of Secretaries and clerks AST/SC 1-6

As you can already guess, people employed in this role fulfil various secretarial and clerical duties. Professionals in the top grades would already be in managerial roles, overseeing the work of others and be engaged in more strategic planning and problem solving.

| Grade | Step 1 | Step 2 | Step 3 | Step 4 | Step 5 |

|---|---|---|---|---|---|

| AST/SC 6 | 5 409,74 | 5 637,08 | 5 873,95 | 6 037,35 | 6 120,77 |

| AST/SC 5 | 4 781,30 | 4 982,22 | 5 192,32 | 5 336,02 | 5 409,74 |

| AST/SC 4 | 4 225,88 | 4 403,45 | 4 588,50 | 4 716,15 | 4 781,30 |

| AST/SC 3 | 3 734,96 | 3 891,91 | 4 055,48 | 4 168,28 | 4 225,88 |

| AST/SC 2 | 3 301,08 | 3 439,81 | 3 584,37 | 3 684,07 | 3 734,96 |

| AST/SC 1 | 2 917,61 | 3 040,22 | 3 167,98 | 3 256,09 | 3 301,08 |

For secretaries and clerks, grades SC1 and SC2 are considered ‘entry grades’. Each AST/SC entry grade requires the following work experience length:

- AST/SC1 requires 0 years of previous professional experience.

- AST/SC2 requires 4 years of previous professional experience.

Detailed overviews of salaries and other benefits of Secretaries and Clerks in grades AST/SC 1-6

* Salary of Secretaries and Clerks AST/SC 1

* Salary of Secretaries and Clerks AST/SC 2

* Salary of Secretaries and Clerks AST/SC 3

* Salary of Secretaries and Clerks AST/SC 4

* Salary of Secretaries and Clerks AST/SC 5

* Salary of Secretaries and Clerks AST/SC 6

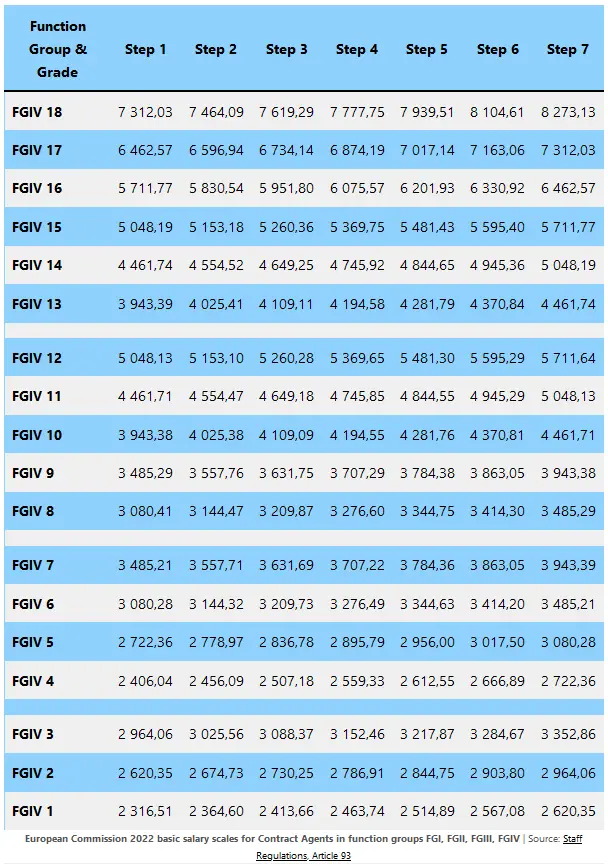

Salaries of Contract Agents FGI-IV

Salaries of contract agents (in French – “agent contractuel”) mostly depend on which function group and grade they are in. You as a candidate cannot influence the function group as that is decided when the post is advertised, however your length of work experience affects your grade (hence – pay). The longer you have worked, the higher the grade.

A general overview of contract agents’ starting monthly ‘basic pay’:

- Function Group IV (grade 13-18): 3943 EUR

- Function Group III (grade 8-12): 3080 EUR

- Function Group II (grade 4-7): 2406 EUR

- Function Group I (grade 1-3): 2317 EUR

The table below contains much more information on contract agents’ pay. In addition to what explained above, you’ll notice ‘steps’ in the table. Most institutions move their contract agents after two years of work. This can happen faster if you perform well and “reclassified”. This can move you faster up the salary scale and you can jump not only steps, but also grades.

| Function Group & Grade | Step 1 | Step 2 | Step 3 | Step 4 | Step 5 | Step 6 | Step 7 |

|---|---|---|---|---|---|---|---|

| FGIV 18 | 7 312,03 | 7 464,09 | 7 619,29 | 7 777,75 | 7 939,51 | 8 104,61 | 8 273,13 |

| FGIV 17 | 6 462,57 | 6 596,94 | 6 734,14 | 6 874,19 | 7 017,14 | 7 163,06 | 7 312,03 |

| FGIV 16 | 5 711,77 | 5 830,54 | 5 951,80 | 6 075,57 | 6 201,93 | 6 330,92 | 6 462,57 |

| FGIV 15 | 5 048,19 | 5 153,18 | 5 260,36 | 5 369,75 | 5 481,43 | 5 595,40 | 5 711,77 |

| FGIV 14 | 4 461,74 | 4 554,52 | 4 649,25 | 4 745,92 | 4 844,65 | 4 945,36 | 5 048,19 |

| FGIV 13 | 3 943,39 | 4 025,41 | 4 109,11 | 4 194,58 | 4 281,79 | 4 370,84 | 4 461,74 |

| FGIII 12 | 5 048,13 | 5 153,10 | 5 260,28 | 5 369,65 | 5 481,30 | 5 595,29 | 5 711,64 |

| FGIII 11 | 4 461,71 | 4 554,47 | 4 649,18 | 4 745,85 | 4 844,55 | 4 945,29 | 5 048,13 |

| FGIII 10 | 3 943,38 | 4 025,38 | 4 109,09 | 4 194,55 | 4 281,76 | 4 370,81 | 4 461,71 |

| FGIII 9 | 3 485,29 | 3 557,76 | 3 631,75 | 3 707,29 | 3 784,38 | 3 863,05 | 3 943,38 |

| FGIII 8 | 3 080,41 | 3 144,47 | 3 209,87 | 3 276,60 | 3 344,75 | 3 414,30 | 3 485,29 |

| FGII 7 | 3 485,21 | 3 557,71 | 3 631,69 | 3 707,22 | 3 784,36 | 3 863,05 | 3 943,39 |

| FGII 6 | 3 080,28 | 3 144,32 | 3 209,73 | 3 276,49 | 3 344,63 | 3 414,20 | 3 485,21 |

| FGII 5 | 2 722,36 | 2 778,97 | 2 836,78 | 2 895,79 | 2 956,00 | 3 017,50 | 3 080,28 |

| FGII 4 | 2 406,04 | 2 456,09 | 2 507,18 | 2 559,33 | 2 612,55 | 2 666,89 | 2 722,36 |

| FGI 3 | 2 964,06 | 3 025,56 | 3 088,37 | 3 152,46 | 3 217,87 | 3 284,67 | 3 352,86 |

| FGI 2 | 2 620,35 | 2 674,73 | 2 730,25 | 2 786,91 | 2 844,75 | 2 903,80 | 2 964,06 |

| FGI 1 | 2 316,51 | 2 364,60 | 2 413,66 | 2 463,74 | 2 514,89 | 2 567,08 | 2 620,35 |

Detailed overviews of salaries and other benefits of Contract Agents in Function Groups FG I, FG II, FG III, and FG IV

* Contract Agents FG I

* Contract Agents FG II

* Contract Agents FG III

* Contract Agents FG IV

Required periods of previous work experience for Contract Agents FGI-FGIV

Each contract agent’s grade requires the following work experience length:

- FGIV grade 13 requires between 0 and 5 years of previous professional experience.

- FGIV grade 14 requires between 5 and 17 years of previous professional experience.

- FGIV grade 16 requires over 17 years of previous professional experience.

- FGIII grade 13 requires between 0 and 5 years of previous professional experience.

- FGIII grade 14 requires between 5 and 15 years of previous professional experience.

- FGIII grade 16 requires over 15 years of previous professional experience.

Required education level for Contract Agents FGI-FGIV

Minimum education for Contract Agents according to function group and grades:

(a) function group I (grades 1-3):

- successful completion of compulsory education.

(b) in function group II (grades 4-7):

- a post-secondary education attested by a diploma, or

- a secondary education attested by a diploma giving access to post-secondary education, and appropriate professional experience of three years. The secondary education diploma giving access to post-secondary education may be replaced by a certificate of adequate professional training of not less than three years on condition that there was no similar professional training giving access to higher education at the time it was issued or,

- successful completion of intermediate education plus two years relevant supplementary specialised training plus five years’ appropriate professional experience.

(c) in function group III (grades 8-12):

- a post-secondary education attested by a diploma, or

- a secondary education attested by a diploma giving access to post-secondary education and appropriate professional experience of three years.

(d) in function group IV (grades 13-18):

- completed university studies of at least three years attested by a diploma and appropriate professional experience of at least one year.

Only diplomas and certificates that have been awarded in EEA Member countries or that are the subject of equivalence certificates issued by the authorities in the said Member countries will be taken into consideration.

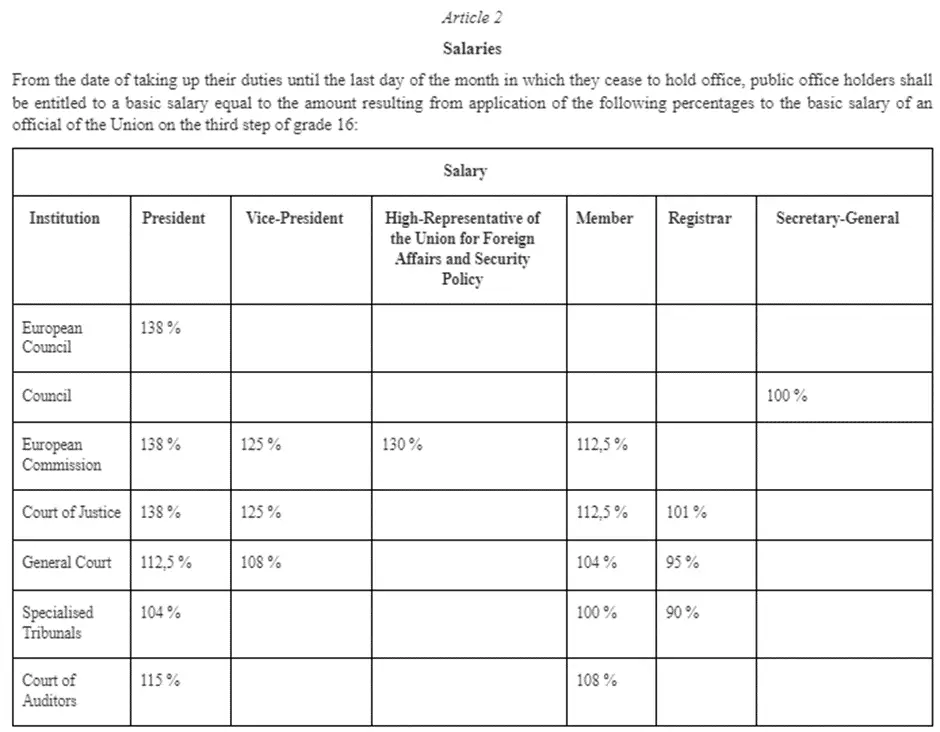

Salaries of European Commission President and Commissioners

Salaries of the European Commission President Ursula von der Leyen and Commissioners are calculated as a percentage of the highest basic salary possible for non-political posts in EU institutions, such as General Directors in DGs.

This refers to the 3rd step of grade 16 in the EU ‘salary scale’. This value as of 1 January 2023 is EUR 23,031.28.

The European Commission President is entitled to 138% of the basic salary of the highest paid non-political EU civil servant. Vice-Presidents get 125%, “regular” Commissioners get 112,5%.

If you are interested in the salary of a particular EU Commissioner, click on a link below.

Salaries of EU Commissioners 2019 – 2024

Allowances and other benefits

Several allowances and other benefits can boost your income by as much as 100% depending whether you are an expat and have a spouse and children. When considering a job at an EU institution, people too seldom take these benefits into account. The European Commission and other EU institutions do a poor job of communicating these benefits to possible employees. Important – these benefits are available to both Administrators and Assistants (AD 5-16 and AST 1-11) as well as Contract Agents (FG I to FG IV).

- Travel costs on taking up duties

- Daily subsistence allowance (during probation period)

- Installation allowance and coverage of removal costs (one-time payments)

- Expatriation allowance or Foreign Residence allowance

- Household allowance

- Dependent child allowance

- European School enrollment for children or Education allowance if there is no local EU school

- Healthcare costs reimbursement to a level of 80-85% through the EU’s Joint Sickness Insurance Scheme (JSIS) for the employee and any direct family members and dependents. 100% reimbursement of costs in case of a serious illness

- Accident insurance

- Annual travel compensation. If your institution is in Brussels, for a 4-person family from Rome this will amount to EUR 2781. For a single person the amount will be EUR 677.

- Birth grant

- Parental leave

- Unemployment allowance

- Removal expenses when leaving your home country and again when leaving your EU institution

- EU pension, survivors and orphan’s pensions, invalidity allowance

- Lump sum payments in case of permanent invalidity or death

- Lump sum funeral expenses, around EUR 2350

Read also about 16 advantages of working for the European Commission and other EU institutions

How much tax do EU officials pay?

The salaries of employees of EU institutions are are exempt from national tax. This means that you really do not have to pay any tax from your salary in your country of origin. Even if you have to or want to file an income/tax declaration with the national institutions, there is usually a separate form for EU employees that’s tailored to the special tax regime.

Social security contributions (% of basic salary)

The following social security related deductions are made from your salary:

- Pension contributions 10,1% of the basic salary

- Health insurance 1,70% of the basic salary

- Accident insurance 0,10% of the basic salary

- Unemployment insurance 0,81% of the basic salary

The EU also collects a special solidarity levy of 6% which is deducted directly from the salary. The rate is 7% for officials in grade AD15, step 2, and above, but this applies to probably a few hundred persons in the whole of EU institutions. This levy is applied from 1 January 2014 to 31 December 2023.

Income tax

EU employees are also paying an EU Income Tax of 8% to 45% applied progressively depending on the size of your salary. The more you earn, the larger the EU Income Tax. The EU income tax remains at 8% for annual salaries below approximately 60000 euros.

It’s important to note that your salary as an EU official is exempt from national tax in your country of origin.

Interested in this topic? Read the in-depth article about taxes for EU officials.

The Correction Coefficient

One of the main factors that impacts your take-home pay in an EU job is the ‘correction coefficient’. The EU annually tracks how expensive it is to live in any particular country and assigns a coefficient with Brussels being 100%. If you end up working or an EU institution located in the East or South of the EU, be ready for a substantially lower take-home pay compared to your Brussels colleagues.

Read more about the correction coefficient.

Visuals for download or sharing

European Commission 2023 basic salary scales for Administrators AD5-16

European Commission 2023 basic salary scales for Assistants AST 1-11

European Commission 2023 basic salary scales for secretaries and clerks AST/SC

European Commission 2023 basic salary scales for CONTRACT AGENTS FGI, FGII, FGIII AND FGIV

This article is based on the European Commission Staff Regulations and other publicly available information such as EU institutions’ vacancy announcements.

Do you have question or suggestion for this article? Please share in a comment below and let’s make this resource better for you and other readers!

Top image: Berlaymont building European Commission headquarters | (c) Fred Romero, CC BY 2.0, Flickr

Leave a Reply